The revenue recognition standard, ASC 606, represents the most sweeping change to revenue accounting rules in years. Now is the time for software and high tech companies to ready themselves and begin working toward compliance. NetSuite’s Advanced Revenue Management solution enables a streamlined revenue accounting function to ensure compliance with current and future FASB and IFRS guidelines.

Understanding NetSuite’s Advanced Revenue Management (ARM)

NetSuite Advanced Revenue Management (ARM) was built to streamline month-end processes so companies can close their books faster and be more confident with their revenue numbers. ARM provides point-and click configuration for customers to handle the complexities of ASC 605, 606 and IFRS 15 standards. Users will know that all of their transactions are compliant. This includes managing the lifecycle of multiple elements and allowing for event-based rules, flexible fair value pricing and real-time analytics.

NetSuite’s Revenue Recognition Model

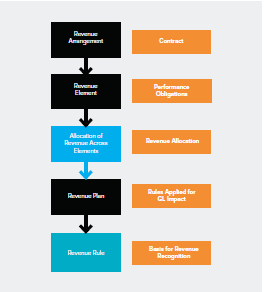

NetSuite’s revenue management tools provide robust and comprehensive configurable capabilities based on requirements of ASC 605 and ASC 606/IFRS 15, enabling systematic compliance for complexities associated with managing revenue contracts. Shown below is the new five-step model for revenue recognition under ASC 606.

In designing the data model for advanced revenue management, NetSuite considered the ASC 606 model to ensure the solutions would be consistent and intuitive.

NetSuite’s Revenue Accounting Model

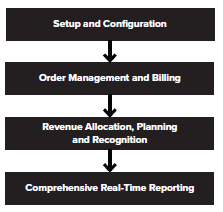

A high-level view of NetSuite Revenue Accounting is shown below.

The revenue arrangement is the transaction that represents revenue contracts. Elements under that arrangement represent performance obligations, and the sources of those elements could be the sales transaction lines, projects or subscriptions. The transaction price is determined based on the discounted sales amount of the element.

Revenue is allocated as appropriate between the elements, if the arrangement is identified as a multi-element arrangement. Each element is associated to a revenue plan based on revenue rules, which dictate when the amortization of revenue can commence and the time frame over which it is amortized.

Key Features and Attributes of ARM

The key elements and benefits of NetSuite’s Advanced Revenue Management include:

These components are:

Setup and Configuration

This primarily includes items, fair value prices and revenue rules. The intention is to set it and forget it. If configured correctly, most transactions in ARM will be fully automated. The revenue accountant’s job is to manage expectations.

Order Management and Billing

This refers to the sales processes which feed information to the revenue arrangement. From the user’s perspective, ARM’s order and billing processes are meant to be entirely separate from the revenue process. This allows sales reps and sales operations to perform their jobs without worrying about revenue process issues holding up transactions. It allows for easy and proper segregation of duties by ensuring that users only have to see and touch transactions within their domain. At the same time, those sources are still able to influence the revenue processes where appropriate.

Revenue Allocation, Planning, and Recognition

Revenue processes include contract creation, allocation, planning and recognition of revenue. The revenue process is all about gaining efficiency, power and insights. Since the revenue arrangement is separate from order management and billing, this allows companies to have separate approval processes and separate people concentrating on different areas of the business. Beyond the power of fair value pricing and automatic allocation of revenue between elements, NetSuite’s Advanced Revenue Management offers the capability to merge arrangements to represent linked orders and provides an easy way to amend revenue plans to accommodate events such as changes in rates, quantities and end dates.

Reporting

Information from the previous components feed into NetSuite’s comprehensive suite of real-time reporting. This suite assists in managing month-end processes, like tying outstanding detailed deferred revenue to the balance sheet and determining what portion of deferred revenue should be reclassified as long-term deferred. All the while, organizations are able to gain real-time insights at the arrangement level, see how revenue amounts for each element are calculated, and see an audit trail of arrangements, elements, and plans if things change over time.

From a managerial reporting perspective, there are forecast reports that adapt as actual revenues are recognized compared with planned revenue. All reports have the ability to drill down into detailed reports and ultimately to the transactions themselves.

ARM Multi-Book

NetSuite’s revenue management software works with their ARM Multi-Book feature to allow users to record the same transaction in separate books, according to separate rules. This can be useful for companies where a subsidiary might be recording in a primary book according to US GAAP, and a secondary book according to local country standards. It’s also useful for companies that want to start looking at their transactions under ASC 606, while continuing to record and report in their primary books under 605.

Best Practices for Setting up Advanced Revenue Management

When using NetSuite’s ARM software, best practices from a revenue recognition perspective include setting up three key elements: revenue rules, item or product configurations, and fair value prices:

Revenue Recognition Rules

Revenue recognition rules are generic rules that eventually become revenue schedules or plans. A small number of rules can be used over time for many contracts and elements. An example of a rule is “percent complete”. If this rule is used, revenue is going to be recognized based on project completion. There are also event-driven rules, which can be based on event amount and event quantity. Other rules may be based on the amount billed, or a forecast rule, where a forecast Rev Rec schedule is created based on a rule.

“These revenue recognition rules are very powerful and there are a lot of options. They are extremely flexible and we can do a lot of things with them.”Joe Friedman

Director, Finance Center of Excellence, NetSuite

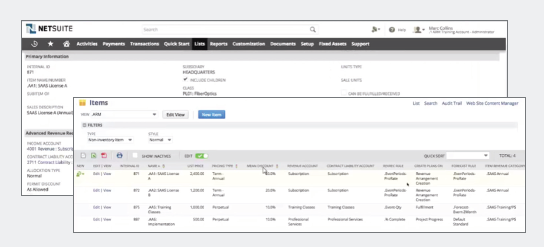

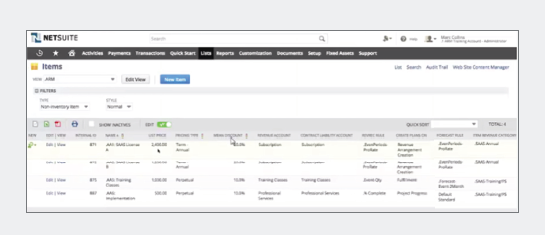

Basic Item or Product Configuration

The item configuration in ARM is the default behavior, and for every item there are multiple fields to be configured (shown above). The idea is to configure, automate and manage by exception; the rules can easily be changed if necessary.

An important area where configuration has great value is pricing. Show is the list price, the pricing type (such as annual or perpetual licenses), the mean discount, revenue account and contract liability information, the default revenue recognition rule, when to create the Rev Rec schedule (which differs by product/service) and the item revenue category.

Fair Value Prices

NetSuite has an extremely powerful fair value engine and can create fair value prices in a number of ways. NetSuite can set fair value prices in a one-to-one relationship between a fair value price and a product, or can have multiple fair value prices for one product.

To summarize: Getting starting with NetSuite’s Advanced Revenue Management requires setting up revenue recognition rules, basic item or product configuration and fair value prices. Once the setup of ARM has been completed, everything is automated and revenue recognition happens automatically.

Additional ARM Software Components Worth Describing

NetSuite’s Advanced Revenue Management also includes powerful capabilities like revenue arrangement, and revenue summary reports.

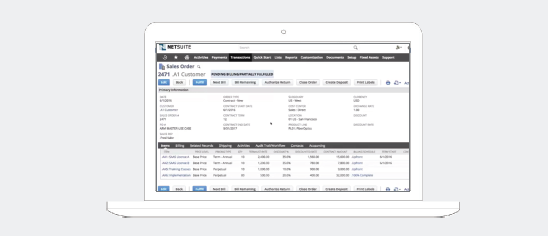

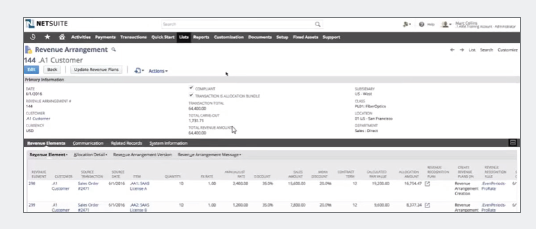

Revenue Arrangement

This is the revenue contract, which is the key piece of the whole ARM Rev Rec engine. It is created automatically based on the setup. ARM enables companies to fully meet the five steps of the new revenue recognition standards:

- Identify a contract with a customer – a new contract is driven by a sales order.

- Identify the performance obligations – items on sales contracts are converted to revenue elements within ARM and all crucial information about a sale is contained and visible, with audit trails about each element.

- Determine the transaction price – ARM automatically provides this information.

- Allocation the transaction price to the performance obligations – using information in the system, calculated fair values are used to allocate the transaction price across the performance obligation.

- Recognize revenue as the performance obligation is satisfied – as a performance obligation is satisfied, revenue is automatically recognized.

Once the appropriate steps are taken to set up ARM for revenue recognition and the transactions begin to occur and flow through the system, the standards set forth by ASC 606 will be fully satisfied by NetSuite’s ARM in a simple, easy and automated way. This ensures compliance while providing managers with full visibility. With this setup of Rev. Rec, three things are posted by ARM to the GL: invoices, Rev Rec Journal entries and deferred reclass entries. The revenue arrangement is a container for this information.

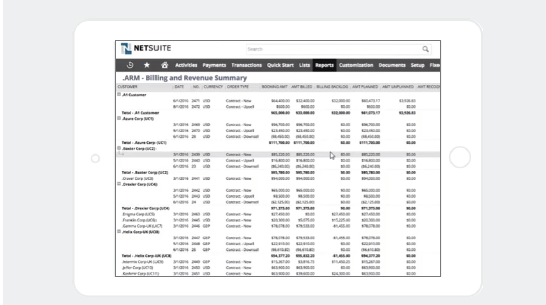

Billing and Revenue Summary Report

The ARM Billing and Revenue Summary Report is a great report that keeps track of everything as it relates to a specific order, including the:

- Total booking amount

- Total amount billed

- Billing backlog, which ties the billing schedule for what is remaining to bill

- Amount planned, which is revenue planned in the future and is tied to the forecast

- Amount recognized

- Net contract liability (there is also a contract liability report)

Also helpful is ARM’s Manage Rev Rec page, which is a holistic view of all Rev Rec across all customers, and provides the ability to manage by exception. Within this report, it is possible to put something on hold or take something off hold and catch it up, or change the start or end date on a rule or a plan that hasn’t been done yet.

Using the Manage Rev Rec page, it is possible to filter information in the revenue arrangement and see the rules for a particular order.

Meeting ASC 606 With NetSuite ARM

Will the ever-changing accounting standards, companies are concerned about preparing for revenue recognition related to ASC 606 while also managing their books according to GAAP. NetSuite has the tools that companies need. The Advanced Revenue Management solution is flexible, scalable, dynamically linked and provides all of the capabilities and real-time information needed to effectively manage the revenue recognition process. By using NetSuite’s Advanced Revenue Management, managers will be equipped with data, reports with audits and manage the business more effectively.

Ask Our Experts

Interested in how NetSuite solutions can benefit your business? Please contact a member of Withum’s Business and Management Consulting Services team.