President Biden has proposed significant changes to the tax code aimed at increasing taxes on the top 1% of Americans. According to the Committee for a Responsible Federal Budget, a bipartisan think tank, wealthier Americans will see an increase in income taxes of 13%-18%. Details have yet to emerge, but it is almost certain that the administration will aggressively pursue legislation since the Democrats control both chambers of Congress. Key provisions include:

| Current Law | Biden Proposal |

| Ordinary Income Tax Rates(e.g., wages, short-term gains) | |

| Ordinary Income: 37% top rate for single and joint returns earning $523,600 and $628,300, respectively | 39.6% for single and joint returns earning $452,700 and $509,300, respectively |

| Investment Income | |

| Long-Term Capital Gains & Qualified Dividends: 20% top rate | 39.6% top rate for single and joint returns with income exceeding $500,000 and $1 million, respectively |

| Interest, Non-Qualified Dividends: 37% | 39.6% top rate for single and joint returns earning $452,700 and $509,300, respectively |

| 0% capital gain tax on assets held until death (i.e., stepped-up basis), with limited exception for primary residences | Capital gains tax applies for gain in excess of $1 million per estate |

| Built-In Gain for Trusts and Partnerships: Indefinite deferral | Gain triggered after 90 years |

Biden also proposed $80 billion to expand IRS audit activity, primarily for those earning in excess of $400,000.

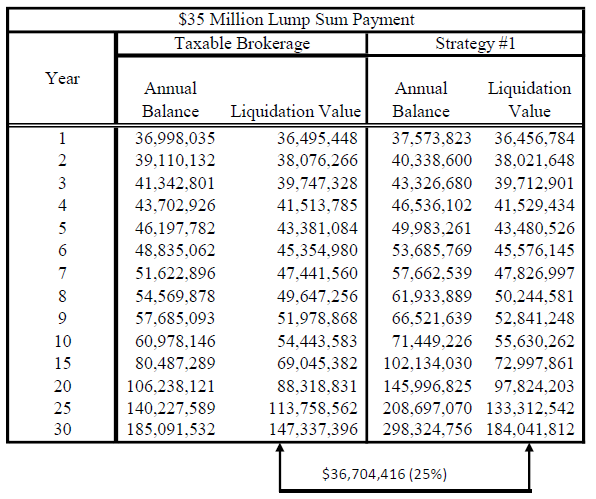

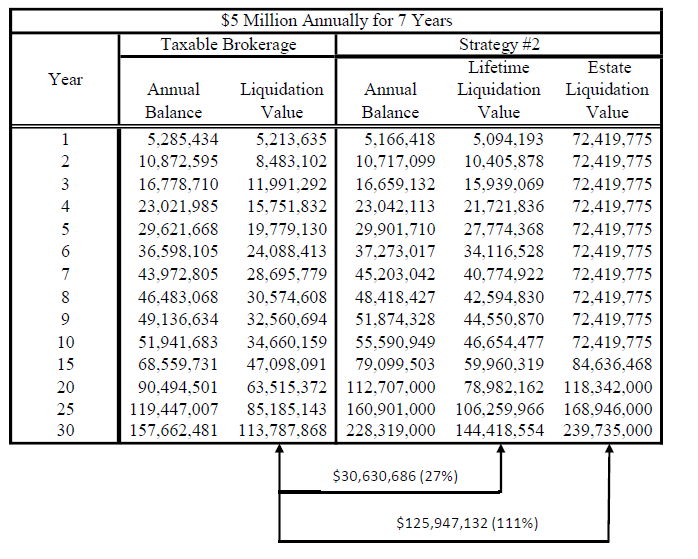

Specialized vehicles exist in which investment income tax can be deferred or eliminated. They do not necessarily require a change in investment manager or strategy. Any individual with $100,000 or more in taxable investment income should explore this option. The following tables compare a fully taxable account to an alternative strategy

Basic Strategy under Biden Proposal: The Power of Deferral

Enhanced Strategy under Biden Proposal: Power of Deferral “plus” Step-Up to Heirs

Key Assumptions and Disclaimer

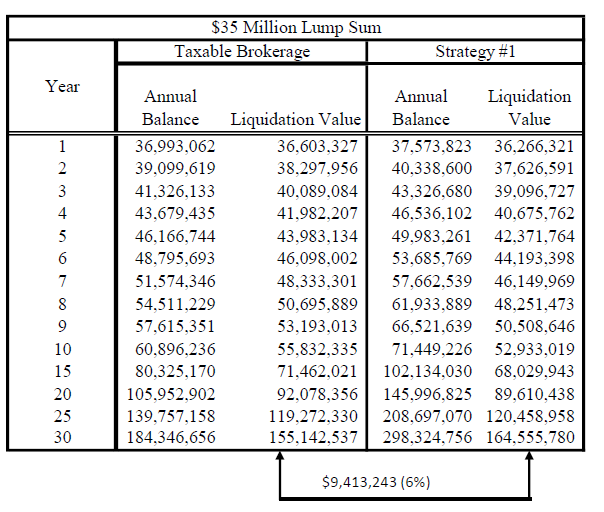

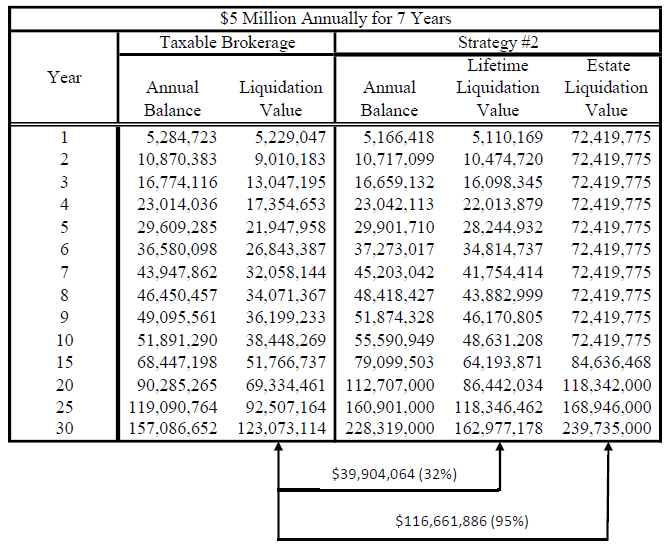

- Income tax rate is 43.4% representing the 39.6% maximum rate and 3.8% Obamacare tax on investment income. Current law is 40.8% representing the 37% maximum rate, 20% capital gains rate and 3.8% Obamacare tax. State income taxes are NOT addressed here.

- Investment earnings are assumed to 8% levelized over time.

- Assumes 30% of the 8% earnings is ordinary income, taxed annually, in a brokerage account. The balance is taxed as capital gains on liquidation.

- Estate taxes are not considered in this analysis.

- Source of Biden Proposal: FY2022 Treasury Green Book

This document is based on generalized and for informational purposes. No one is entitled to rely upon.

Addendum

The proposed strategies provide a benefit under current law even if Biden’s proposal do not pass as proposed. As a result, these strategies should be considered regardless of legislative action.

Basic Strategy under Current Law

Enhanced Strategy under Current Law

Withum’s Team to help address your questions about the current estate tax environment.

Private Client Services