The impact of Revenue from contracts with customers (ASC 606) affects virtually all building industry entities who enter into contracts with customers, whether public or private. ASC 606 has completely replaced all revenue guidance under US Generally Accepted Accounting Principles, including the previous guidance for construction-type contracts under SOP 81-1.

This far-reaching revenue recognition framework will impact a company’s accounting systems and processes, financial reporting and documentation functions, operating software systems, internal controls, and financial ratios. Specifically, Engineering and Construction companies will need to exercise subjective, yet consistent judgement when reviewing and accounting for revenue from contracts with customers under ASC 606.

ALERT: Private engineering and construction companies need to comply with ASC 606 for financial reporting periods beginning after December 15, 2018.

One might say, “Well, does this really impact my company? I am a small contractor, my costs are my costs, and my revenue recognized is not going to change.” There may be some truth to that comment. However, until you walk a representative sample of your contracts through the new ASC 606 guidance, you cannot be sure of that belief. This assessment is imperative because the accounting can vary significantly depending on the conclusions drawn. Once the assessment is completed, it is possible that the application of ASC 606 may only yield a few adjustments, both at the transition stage and the ongoing application of ASC 606. Nonetheless, the application of the new standard requires more robust financial statement footnotes for revenue recognition.

While ASC 606 retains a current method of recognizing revenue over time, there are refinements to the costing inputs that may require a planned and extended effort on the part of the engineering or contractor’s management teams. These enhanced efforts include frequent and regular communication amongst the accounting, project management, and estimating departments. For example, construction companies now need to identify specific job costs associated with mobilization activities such as costs to move personnel, equipment and materials to the project site in order to account for separately and capitalize in accordance with ASC 606 rather than accelerate costs-to-date entirely upfront. If they haven’t already done so, engineering and construction contractors need to identify the impact to their financial statements, financial performance metrics, financing, and tax planning.

So if I haven’t caught your attention yet, please consider the following advice at a minimum. Engineering and construction companies should be reviewing at least some of the various ASC 606 articles, summaries and practice aides available and commence ASC 606 planning immediately. One might ask why? Well, say for example, if a company has a reporting cycle that ends on December 31, 2019 and issues comparative financial statements, then the company will need to choose one of the two available transition methods each having qualitative and quantitative considerations that take careful analysis, a collaborative effort by management and enhanced internal documentation to implement. For these reasons, engineering and construction associations across the country are doing everything they can to educate and alert their most valuable members on the urgency to assemble an internal revenue recognition task force, digest the new ASC 606 standard, review existing in-place contracts, apply the new five-step process for revenue recognition, determine the transition method they wish to use to adopt the new standard, and communicate with their trusted advisors on any anticipated effects to their company.

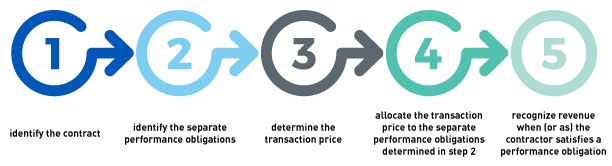

The fundamental principle of the new five-step recognition process is to recognize revenue such that it depicts the consideration which the company expects to be entitled to in exchange for the transfer of promised goods or services to its customers. The key to this five-step process is that the steps are to be achieved consecutively, or else proceeding to the next step will not be possible. Those steps are illustrated below:

So again, one may say, “This has little to no impact on my financial statements.” However, to further emphasize the importance, I liken the ASC 606 implementation process to that of injuring one’s ankle. Would one rather run to the urgent care center, receive treatment and be told they have a very bad sprain injury versus not seeking care and finding out after weeks of letting it go that they did in fact break their ankle which now requires more extreme measures and pain to correct it?

Many say the implementation process is a good exercise for companies, and a sort of renewal process for clarifying terms within existing and upcoming long-term contracts. For a painless approach, starting the implementation process now will prove to be essential for all companies. The early implementation provides for the improving or enhancing of accounting policies and procedures, the development of significant judgements and estimates, the identification of performance obligations, the assessment of the probability of collection, and the analyzing of contract modifications including change orders, time and material tickets, incentives and/or liquidated damages. Additionally, a proactive implementation process enhances pertinent dialogue with their trusted advisors regarding the anticipated effects to their financial statements and related disclosures, financial performance metrics, financing, and tax planning.

Ultimately, engineering and construction companies will make several new significant judgements and apply several new concepts upon adoption of the new revenue recognition standard – ASC 606. They may reach different conclusions about the number of performance obligations or the amount and timing of variable considerations (i.e. performance awards or claims) to include in the transaction price. Even if the accounting impact is minimal, companies realize now that early implementation of the new standard allows for a more painless transition. Benjamin Franklin said it concisely, “If you fail to plan, you are planning to fail!”

More of Withum’s Construction Services

How Can We Help?