Across nearly every industry, larger companies command higher valuation multiples. Economies of scale, improved market positioning, and enhanced investor confidence have long been perceived to have an inverse relationship with risk. Although revenue size often correlates with higher valuation multiples, there is more to the story. Profitability, capital efficiency, industry factors, and overall risk profile are also important considerations. By contextualizing scale within a company’s financial profile and industry, investors and analysts can better understand how multiples reflect both history and future expectations.

Valuation Drivers

Although not the sole factor influencing multiples, revenue size plays an outsized role. This can create an opportunity for investors to acquire and integrate smaller businesses into a larger entity to achieve multiple arbitrages. Furthermore, market sentiment surrounding an acquisition can impact valuation. While aggregate scale matters, even more so consistent increases in historical revenue display a degree of stability and maturity that commands a higher valuation multiple. By incorporating a wide variety of quantitative and qualitative information, valuation multiples are an effective distillation of historical and potential future success.

Industry Examples

Research indicates that valuation multiples tend to increase with revenue scale across various industries, for example:

- Technology: High-growth tech firms often trade at revenue multiples exceeding 10x, while smaller startups may be valued at 3x–5x revenue.

- Consumer and Retail: Larger, well-established brands in C&R often trade at revenue multiples of 1x-2x, while smaller or lower-margin retailers may see valuations closer to 0.5x-1x.

- Healthcare: Scaled healthcare companies, especially in specialized services, can command revenue multiples of 3x-6x. Whereas general providers typically trade around 2x and below.

Size Premium and Its Drivers

The size risk premium is a fundamental risk consideration that small-capitalization companies suffer in valuation relative to mid or large-capitalization companies. Size risk premiums can add upwards of 500 to 1,000 basis points to a company’s cost of capital. These smaller companies have increased risk due to two main factors. Firstly, small-cap companies carry a degree of inherent risk because many are in pre-revenue/early revenue stages. Early-stage companies tend to receive lower valuations due to limited operating history compared to mid and large-capitalization companies that typically have more established historical figures, a strong indicator of stability, and indicative of repeatable future success. From a management perspective, a large percentage of the risk built into the size premium comes from this gap in volatility that we see between small-cap and mid/large-cap firms.

Furthermore, there is additional liquidity risk to a prospective investor. Debt and equity holders in large to mid-cap companies are much more likely to receive distributions/dividends or have the opportunity to sell their interest. Larger, more stable companies are expected to see less significant, but more constant growth. In the event of an unexpected disruption, debt and equity holders are also much more likely to recoup capital, given that large to mid-cap companies are more heavily capitalized with tangible assets.

Shareholders can expect relative ease when it comes to getting in and out of positions with these types of stocks. This idea often isn’t as applicable to small-capitalization companies, given that there are fewer buyers and less marketable tangible assets to rely on. Investors are willing to take lower returns if it means that their investment is backed in a more liquid environment, explaining the higher risk and return that can come with investing in smaller companies. These investors are in a position where they are expected to hold their inherently riskier position for an extended period, which explains the demand for a higher return. In addition to liquidity risk, small-cap companies face governance risk, a lack of price transparency, and concentration of ownership.

This theme can also be seen in private companies where lenders may expect a higher yield. These elevated lending rates are typically a reflection of:

- the associated risk of achieving high growth expectations;

- lesser access to capital than larger peers; and

- a higher concentration of intangible assets.

Lenders address this by charging higher interest rates to early-stage private companies with less collateral and high potential. To see this theory in action, let’s explore how valuation multiples can be leveraged in M&A.

Case Study: Multiple Arbitrage in M&A

Consider the following example:

| Acquiring Company: EBITDA = | $10M, Multiple = 7x, Value = $70M |

| Acquired Company: EBITDA = | $1M, Multiple = 3x, Value = $3M |

| Combined Entity: EBITDA = | $11M, Multiple = 7x (assuming no change), Value = $77M |

| Net Value Added: | $4M |

In the example above, the acquiring company is valued at 7 times its earnings (EBITDA), and the target company is valued at 3 times. After the acquisition, the combined entity may remain valued at the 7x multiple of the acquirer, but now includes the target’s earnings. Now, an extra $4 million in Value has been created, as the target’s earnings are now valued more generously as it has joined the combined entity. This illustrates how acquiring a smaller company at a lower multiple can lead to an increase in overall enterprise value, i.e. multiples arbitrage.

Furthermore, the market’s reaction to a merger or acquisition can significantly influence the company’s valuation. Acquisitions give the market new, vital information to consider. This often takes the form of potential synergies to be realized. Along with this, acquisitions can be an indicator of the buyer’s stability and desire for growth and market expansion. Strategic and effective acquisitions create accretive deals that drive value growth.

While this market phenomenon works in theory and plays out sometimes in practice, the acquiring firm may experience the opposite market reaction as well with multiples falling post-transaction. This effect can be due to a variety of factors, including:

- Market Conditions: Concurring economic downturns or industry-specific challenges can compress multiples.

- Integration Risks: A deal is only as good as its integration, and operational inefficiencies or cultural misalignment may erode expected gains.

- For example, the merging of two companies can bring personal conflicts that were not foreseen in theory. Problems with management at the executive level can derail an acquisition that was once theoretically sound.

- Realization of Synergies: Not all synergies play out in practice as they were thought to, especially revenue synergies. However, cost-saving synergies are typically much more achievable when companies merge.

- Investor Sentiment: Investors may perceive an acquisition as overly ambitious, poorly timed, or lacking strategy. This skepticism can drive down the acquirer's valuation multiples.

Research

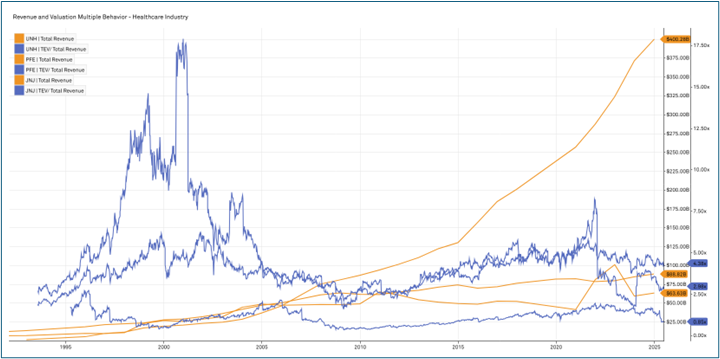

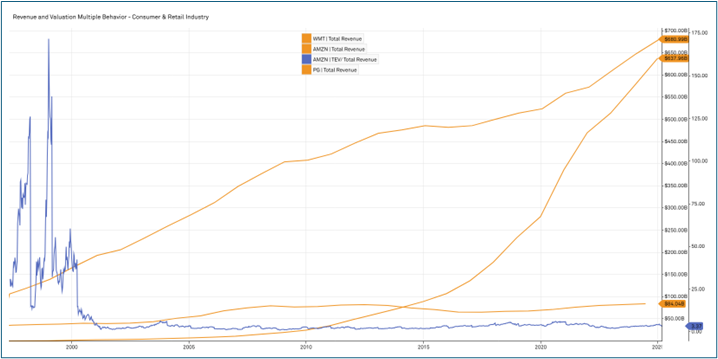

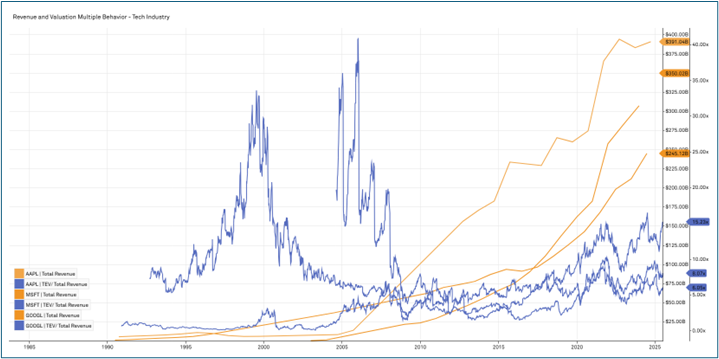

The graphs below show a history of the revenue and EV/Revenue multiples of large U.S.-based companies across three industries – Technology, Healthcare, and Consumer & Retail.1 Each figure displays various companies within their respective industry, highlighting their revenue (orange) and the multiples (blue) across the life of the firms. As these companies grew from their founding date to the present day, notice how the valuation multiple behaves in relation to the scale. This is the market’s depiction of a company progressing from immature to stabilized and how valuation multiples behave over that lifecycle.

Analysis

The trend for these industries allows us to gain a stronger understanding of how revenue impacts not just the valuation multiples of a company, but the behavior of these multiples over time. Across Technology, Healthcare, and Consumer & Retail, there is an evident correlation between EV/Revenue multiple and revenue size. For these companies, in the earlier, more unstable stages in terms of size and revenue, the valuation multiples behave much more erratically, which can act as a ceiling on valuation.

It can take decades to reach this level of security, but once a company reaches a specific size through its consistent, growing revenue streams, its valuation multiples behave more predictably. The scale of the company can predict this difference in behavior of multiples. While scale itself is not the primary driver (i.e., the reason that we study multiples in the first place), it is rather the corresponding level of stability and maturity that is exhibited by larger companies and rewarded by the market. Additionally, higher revenues can increase profitability, margin expansion, and scale in negotiating with customers, suppliers, and lenders to deploy working capital and leverage more efficiently.

This demonstrates that investors care more about the predictability and sustainability of revenues than absolute values. Companies with high recurring revenue, diversified customer bases, and other qualities indicative of stability command higher valuation multiples than those with volatile or transaction-dependent business models. Tech companies, for example, may consistently trade at higher multiples than companies within more transaction-based industries, as seen in the graphics above. When looking into the relationship between revenue and valuation, it is necessary to weigh qualitative details in tandem with quantitative data.

Takeaways

The relationship between scale and valuation multiples is evident across industries, with larger firms generally valued at premium multiples due to their operational stability, market influence/dominance, and overall potential. The analysis of valuations across different-sized companies of various industries displays that with size comes security and strength. Revenue and liquidity are vital factors in evaluating a company’s overall stability. That strength and stability are within themselves that must be accounted for in all corporate valuations, as companies that possess these qualities have tangible advantages against those that don’t. Larger companies consistently exhibit greater financial health, more predictable revenue streams, and, consequently, superior valuation. Scale will always remain as a foundational driver of valuation multiples, but it is vital that this is not the only information to consider when valuing a company. The company and its scale must be contextualized within the broader industry and market, as various factors, such as revenue quality and market positioning, also play a key role in arriving at a holistic valuation of a company.

If you or your client is contemplating a buy or sell-side transaction, you’re likely keenly focused on the correct Value. At Withum, our Corporate Valuation Consulting Team comprises credentialed and highly experienced professionals who regularly advise on these types of deals. With access to premier research tools, in-house industry leader expertise, and a proprietary database of over 5,000 valuations, our professionals provide a unique work product, not a boilerplate analysis. Our analyses are comprised of a detailed quantitative and qualitative analysis that sets us apart from our competitors. Whether you are trying to achieve multiples arbitrage or scale growth through that next round of financing, valuation is critical. Don’t take a chance. Reach out today.

Authors: Anthony Venette, CPA/ABV, MBA | [email protected], Michael Rasin | [email protected], Ethan Dobrindt, and William McCormack

Contact Us

For more information on this topic, please contact a member of Withum’s Forensic and Valuation Services Team.