The Affordable Care Act (“ACA”) introduced the requirement for applicable large employers (“ALEs”) to offer healthcare coverage to their full-time employees and the applicable reporting requirements associated with healthcare coverage offered. The Employer Shared Responsibility (“ESR”), under Internal Revenue Code (“IRC”) §4980H, requires ALEs to offer healthcare coverage to their full-time employees that is affordable and provides minimum value or face a potential shared responsibility payment for failure to do so.

In addition, certain employers will have reporting requirements associated with healthcare coverage offered and/or provided under IRC §6055 and IRC §6056. Please refer to our March 10, 2015, Withum Weekly Pulse for detailed information on the ESR and employer reporting requirements.

EMPLOYER REPORTING REQUIREMENTS

Final regulations, released in February of 2014, provide guidance to providers of minimum essential health coverage that are subject to the information reporting requirements of IRC §6055 and to ALEs that are subject to the information reporting requirements under IRC §6056.

Persons required to report under IRC §6055 will do so by filing:

- Federal Form 1094-B, Transmittal of Health Coverage Information Returns, and

- Federal Form 1095-B, Health Coverage.

Persons required to report under IRC §6056 will do so by filing:

- Federal Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns, and

- Federal Form 1095-C, Employer-Provided Health Insurance Offer and Coverage.

INTERNAL REVENUE SERVICE FACTS

In a recent release the IRS issued various facts with respect to the above referenced information reporting statements to be filed in early 2016. The facts, as discussed in the release and included on the IRS website; www.irs.gov, are outlined below.

- An ALE is required to file Form 1094-C with the IRS; however, an ALE is not required to furnish a copy of Form 1094-C to its full-time employees;

- Generally, an ALE must file Form 1095-C or a substitute form for each employee who was a full-time employee for any month of the calendar year;

- An ALE that sponsors a self-insured plan must file Form 1095-C for each employee who enrolls in the self-insured health coverage or enrolls a family member in the coverage, regardless of whether the employee is a full-time employee for any month of the calendar year;

- Form 1095-C is not required for the following employees unless the employee or the employee’s family member was enrolled in a self-insured plan sponsored by an ALE member:

- An employee who was not a full-time employee in any month of the year or

- An employee who was in a limited non-assessment period for all 12 months of the year;

- If an ALE member sponsors a health plan that includes self-insured options and insured options, the ALE member should complete Part III of Form 1095-C only for employees and family members who enroll a self-insured option;

- An ALE member that offers coverage through an employer-sponsored insured health plan and does not sponsor a self-insured health plan should NOT complete Part III; and

- An ALE may provide a substitute Form 1095-C; however, the substitute form must include the information on Form 1095-C and must comply with generally applicable requirements for substitute forms.

DUE DATES

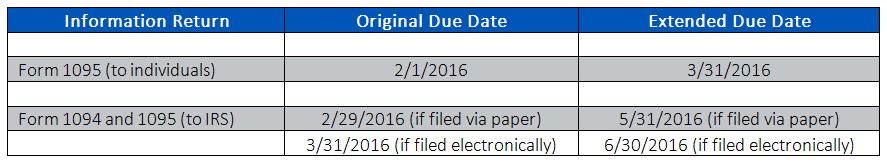

The IRS included an additional fact in its release regarding the due dates of these information returns. However, through the issuance of IRS Notice 2016-4, the IRS has since granted extensions of time to file these returns. Please refer to the chart below for the extended due dates:

The IRS also indicated in this Notice that, for individual 2015 tax return filings, no amendment of any personal tax returns will be required in the event an individual files their personal tax return prior to receiving their Form 1095.

CONCLUSION

In addition to the above facts, the IRS has issued on its website “Questions and Answers about Information Reporting by Employers on Form 1094-C and Form 1095-C”. These questions and answers can be accessed at the following link: https://www.irs.gov/Affordable-Care-Act/Employers/Questions-and-Answers-about-Information-Reporting-by-Employers-on-Form-1094-C-and-Form-1095-C. Employers need to be aware of these filing requirements as the due dates are quickly approaching.

Please contact a member of Withum’s Healthcare Services Group by filling out the form below for further questions or assistance.

How Can We Help?