Inflation, What Went Wrong?

By Anthony DiLorenzo, M.S Accountant WithumSmithBrown, PC

After the crash of 2008 – 2009, the US government along with the Federal Reserve (the “Fed”) implemented massive efforts to avoid a deflationary scenario that was last seen during the great depression. In the years following the initial introduction of these policies, there was plenty of chatter from many economists regarding the risk of serious inflation due to the massive intervention. However, seven years and trillions of dollars later the US has yet to see any measurable inflation and is still fighting off deflationary head winds.

As the recession deepened, the US government went on a spending binge of epic proportions. This was to make up for the loss of consumer spending and to help stimulate the economy. Meanwhile the Federal Reserve would slash interest rates to near 0% and begin what would eventually be known as quantitative easing (“QE”) 1 of 3. In short, the Fed “printed” new money and then bought mortgage backed securities and other bonds from large institutional banks. Many economists and people in the financial media vowed that we would see severe repercussions from these policies in the form of a highly inflationary environment. For a short period of time in 2011 it looked like their predictions might prove to be right as many commodities were making new all-time highs. Fast forward to 2015 and these same commodities have been decimated to levels seen only for a brief period of time during the darkest days of the recession. So the question remains, why were these inflationary scenarios wrong?

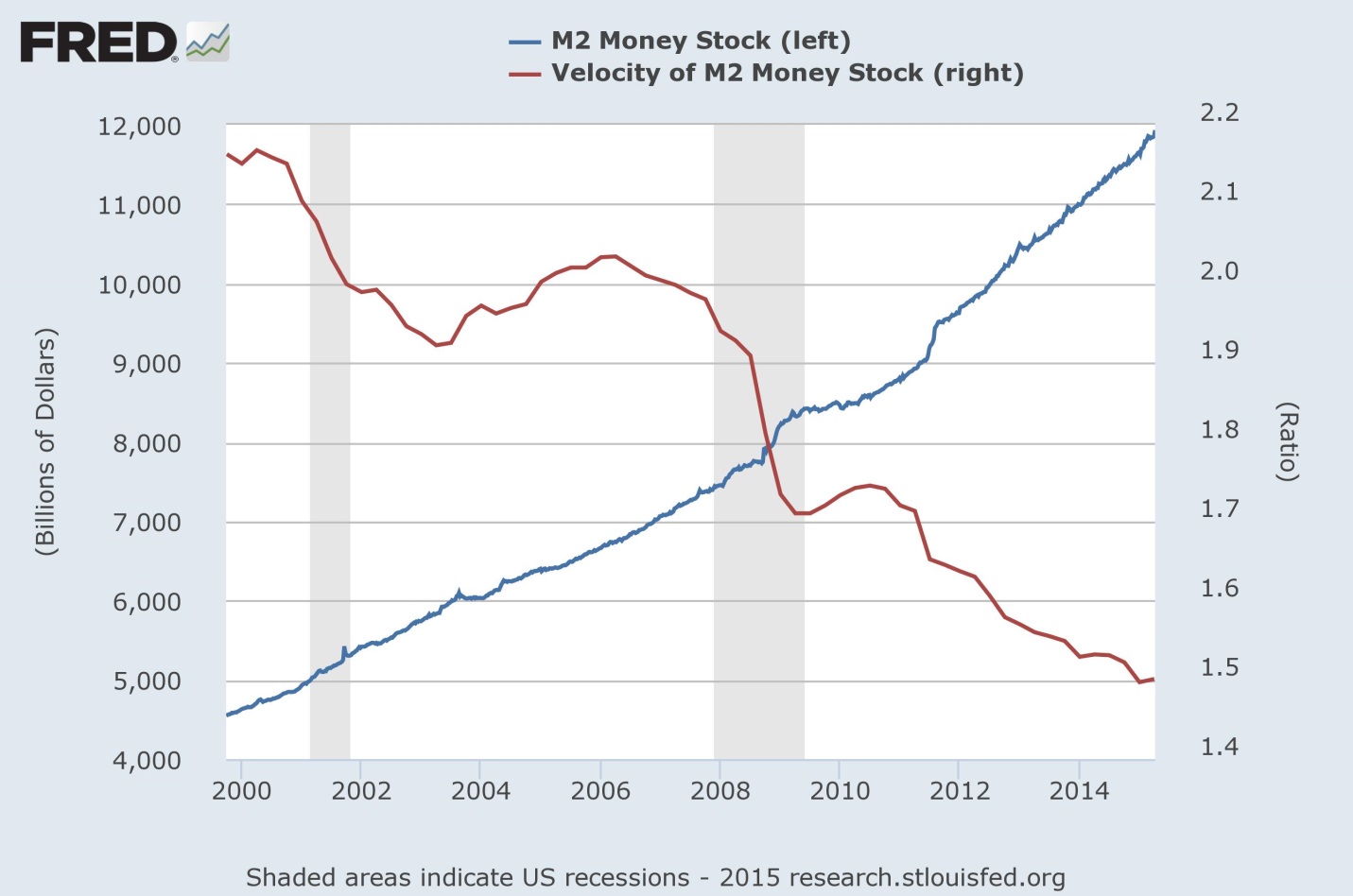

One of the main reasons that inflation has not taken root is due to the velocity of money. The velocity of money is essentially the rate in which money changes hands in an economy. Even though the monetary base has expanded fairly rapidly due to the printing of new money, the slowing velocity has mostly negated the increase in the monetary base (as seen in the chart below). Any future upturn in the velocity should be watched for a signal to a change in the current economic environment.

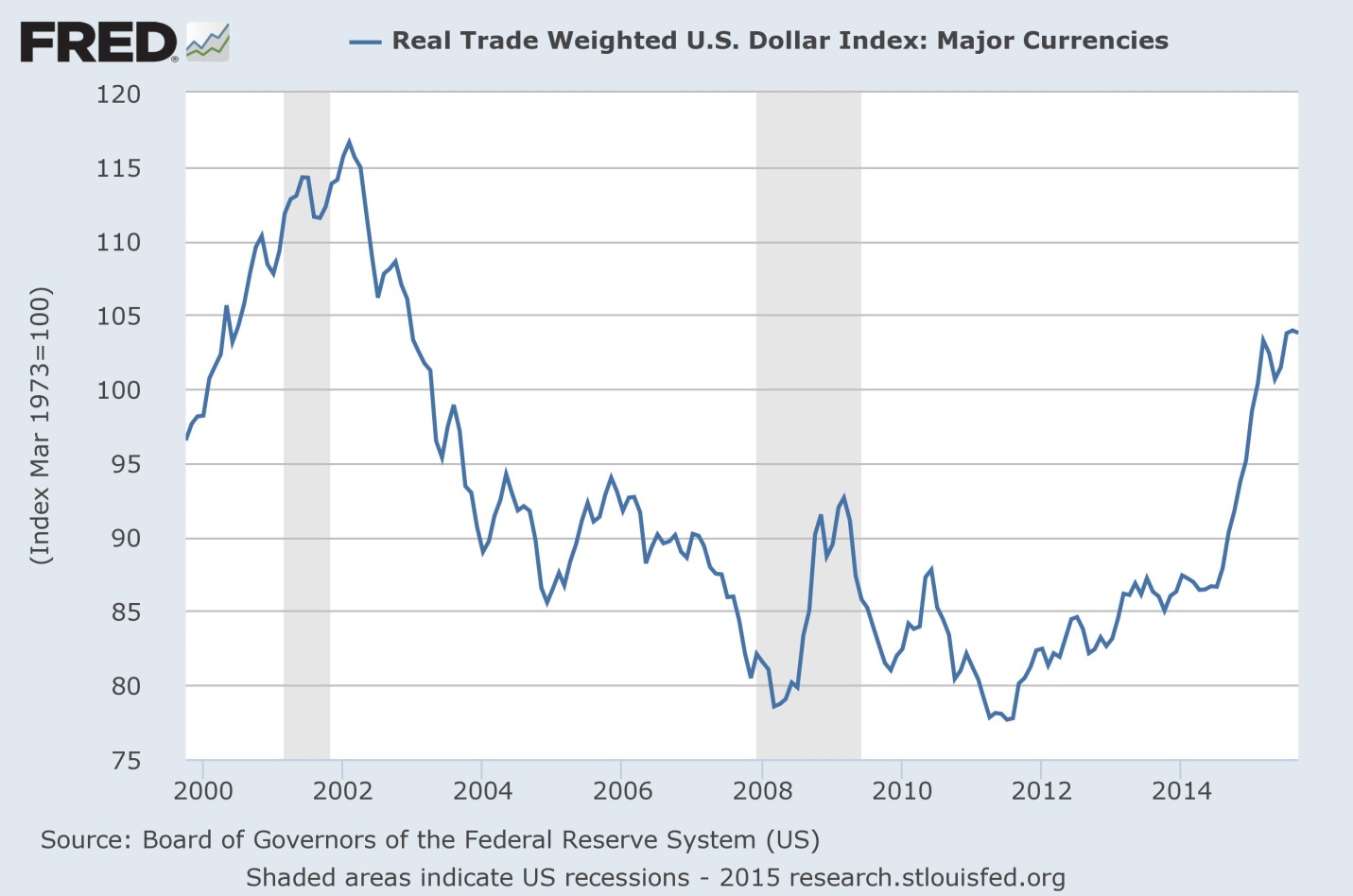

This decline in velocity leads to the second main reason which has come from a money hoarding mentality that has been feeding off itself. Due to a low inflation expectation and low interest rates, banks and consumers alike do not feel pressured to spend money today. This is because it will not be worth that much less tomorrow. In fact, money may even be worth more tomorrow due to the dollar being in a significant bull market vs most currencies since the end of the recession (as seen below). Also, since the recession, banks and consumers alike are slightly more cautions when contemplating accepting higher risk with money.

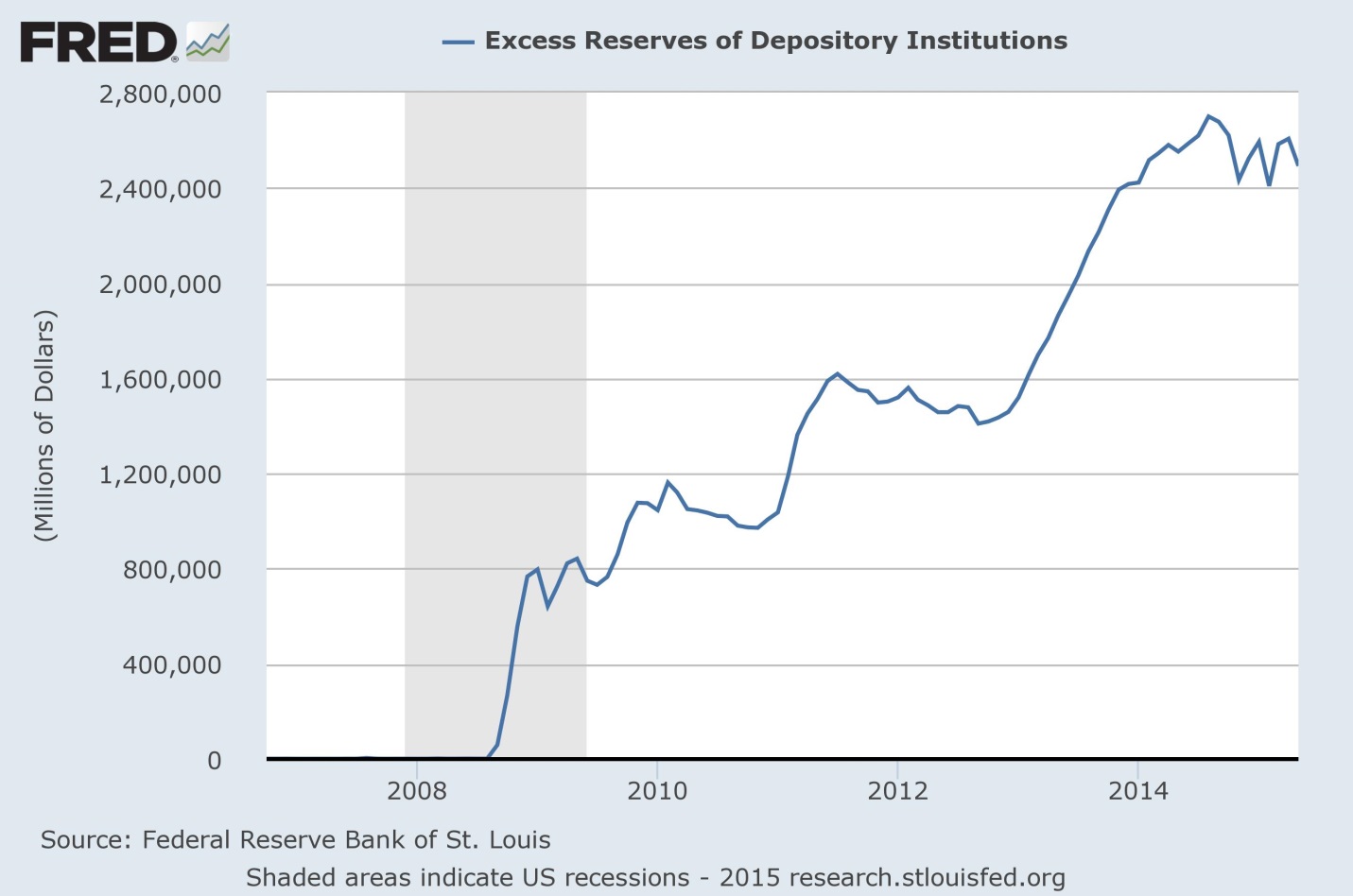

This hoarding can especially be seen in deposits with the Fed. When the Fed was injecting liquidity through its quantitative easing programs, it would “print” money and then purchase assets from various large financial institutions. The expectation was that these institutions would then lend or invest the money they received. However, after doing a few calculations, less than half of the money from QE was actually injected into the economy. The total amount of the Fed’s QE programs amounted to about 3.5 trillion of new money, however about 2.5 trillion was just redeposited back into the Federal Reserve as seen in the following chart.

Another reason for the low inflationary environment is that the US dollar is the most popular reserve currency. Instead of trading each other’s currencies directly, normally one country will convert its currency into US dollars and then convert it into the second country’s currency. This means that central banks around the world denominate some of their reserves in US dollars for this purpose. Causing the total monetary base to be spread out across the globe and is not fully concentrated here at home.

This leads to the final reason for continued less inflation – the infamous carry trade with the yen. The way a carry trade works is as follows: a trader or institution borrows money in a a certain country with a very low interest rate (in this case Japan) and then converts that money into US dollars. They then buy assets with those dollars such as Treasuries that are paying much higher rates than they are paying on the borrowings. Japanese institutions along with the Bank of Japan must then hold very large amount of US dollar reserves. In addition, the purchase of treasuries helps keeps rates in the US low which helps feed the entire cycle.

These reasons are what many economists overlooked when expecting inflation in the years following the great recession. Going forward, the details and indicators listed above should be monitored to see if the current economic climate is about to change.