Presentation of Financial Statements of Not-for-Profit Entities. This paper will discuss the changes proposed by the ASU; these represent the most significant changes in not-for-profit (“NFP”) financial statement presentation since the issuance of FASB statements 116 and 117 in 1995.

What Are the Highlights of the Proposal?

The major changes proposed by the ASU are summarized following. To review the change in more detail click on the applicable link.

- There would be increased disclosure requirements regarding liquidity and an NFP’s ability to meet its current obligations. This overriding change, which will affect virtually all NFP entities, also serves as the impetus behind many of the financial statement format changes that follow. (Liquidity)

- The statement of financial position would present information related to two classes of net assets versus the current three classes. Many NFPs that presently do not have endowment funds will see little more than caption changes to the statement of financial position. (Net asset classes)

- The statement of activities would be revamped to include an operating section and a non-operating section. This proposal will affect virtually all NFP entities regardless of size and mission. Items of revenues, gains, expenses and losses (“REGL”) would be allocated between the operating and non-operating sections based on overarching principles related to the NFP’s mission and the availability of funds to meet current operating needs. The operating section of the statement of activities would be further disaggregated to reflect operations before and after transfers. (Changes to the statement of activities>)

- There would be a new requirement to prepare the cash flow statement using the direct method. As with proposed changes to the statement of activities, this change would affect all NFP entities. Furthermore, certain transactions will have a different classification within the operating, investing and financing activities of an NFP’s cash flow statement than identical transactions would have in a commercial entity’s cash flow statement. (Changes to the cash flow statement)

- All NFPs would be required to present operating expenses by both natural classification and by function in one place within the financial statements or related notes. The current requirement for a statement of functional expenses in the financial statements of voluntary health and welfare organizations would be eliminated. This proposed change would increase reporting requirements for a substantial number of NFPs. (Reporting expenses)

Other important proposals contained in the ASU relate to:

- Changes in the way gifts of equipment are reported in the statement of cash flows. (Changes to the cash flow statement)

- Changes in the way gifts of equipment are presented in the statement of activities. (Changes to the statement of activities)

- Changes in the way healthcare entities, particularly NFPs, present their financial statements including eliminating the requirement to present a performance indicator. (Healthcare entities)

- The manner in which underwater endowment funds are presented in the statement of financial position and disclosed in the notes. (Underwater funds)

- The reporting of investment income and attendant expenses. (Investment income)

Increased liquidity disclosures

A primary impetus behind the FASB’s proposed revamping of NFP financial statements is its concern that the current format does not provide sufficient information regarding an entity’s liquidity, including what those liquidity needs are and the resources available to meet those needs.

Currently, NFP financial statements provide liquidity related information in a number of ways. The use of a classified statement of financial position provides limited information amount resources that are available in the next operating cycle (current assets) as well as the demands on those resources (current liabilities). For entities that do not present a classified balance sheet, the relative liquidity of financial assets is to be presented in the notes to the financial statements.

The ASU proposes to improve liquidity information by requiring new and/or expanded disclosures related to the following:

- A description of the purpose, amounts and types of Board designations, appropriations and similar transfers that result in adding or removing self-imposed limits on the use of resources without donor restrictions.

- The composition of net assets with donor restrictions and how the restrictions affect the use of resources.

- The management of liquidity and specific quantitative information regarding financial assets available to meet near-term demands for cash including demands for near-term financial liabilities.

Qualitative information

Qualitative information related to how an entity manages its liquidity would be required. The following are suggested types of disclosures designed to meet this objective:

- The strategy for addressing entity-wide risks that may affect liquidity including the use of lines of credit

- The policy for establishing liquidity reserves

- The basis used for determining the time horizon for managing its liquidity

Quantitative information

Quantitative information useful in assessing an entity’s liquidity position that includes the following would be required to be disclosed in the notes:

- The total amount of financial assets

- Amounts that are not available to meet cash needs within a self-defined time horizon that corresponds with the time horizon used by the NFP for managing its liquidity due to either of the following:

- External limits

- Internal designations, appropriation and transfers

- The total amount of financial liabilities due within the same self-defined time horizon

The “time horizon” is an entity defined time frame which can be expressed in months or even a one-year operating cycle. The point of this disclosure is for an NFP to specifically identify the amount of financial liabilities that require cash payment within the specified time horizon and the financial assets currently available to meet those requirements. At the same time, the disclosure provides the financial statement user with an understanding of the amounts of financial assets that are not currently available to meet obligations and the extent to which any unavailability of funds is self-imposed. This disclosure provides the financial reader with information that is not immediately available from looking at an entity’s statement of financial position. An example of such a disclosure follows:

NFP A utilizes a 60 day time horizon to assess its immediate liquidity needs. This period of time was established based on management’s review of the typical life cycle of converting its financial assets to cash and typical payments of its trade payables. The entity invests cash in excess of daily requirements in short-term investments.

NFPs would also be required to disclose known liquidity problems; such disclosure could be included in the qualitative disclosures listed above.

Change to net asset classes

The FASB concluded that with the implementation of the Uniform Prudent Management of Institutional Funds Act (“UPMIFA”) the current requirement to distinguish between temporarily restricted net assets and permanently restricted net assets within the statements of financial position and activities has outlived its usefulness. This is because most enacted versions of UPMIFA permit NFPs to invade, at least on a temporary basis, endowment principal.

In addition, the FASB feels that the designation “unrestricted net assets” has led to misconceptions on the part of financial statement users regarding a NFP’s resources available for current operations (liquidity). The term “unrestricted” net assets, while providing an impression of assets that are available to satisfy current obligations, includes assets that may have other than donor restrictions placed on them (such as legal restrictions) thereby making them unavailable for use in current operations.

The proposed ASU combines the temporarily and permanently restricted net asset classes into one new net asset class called net assets with donor restrictions for presentation purposes in the statements of financial position and activities. Information regarding the types and nature of those donor imposed restrictions would be disclosed in the notes to the financial statements.

The current unrestricted net asset class would be relabeled net assets without donor restrictions. Presumably financial statements users will become more attuned to the important difference between assets that are without donor restrictions and assets that are available to meet the NFP’s current obligations. The statement of financial position would display totals for both classes of net assets. The statement of activities would display the change in each class of net assets as well as the total change in net assets.

The requirement to display total assets, total liabilities and total net assets within the statement of financial position would be retained.

In order to improve disclosure related to liquidity, NFPs would be required to provide more information regarding governing body self-imposed limitations on net assets without restrictions.

The proposed changes to the statement of financial position are largely cosmetic in nature. While the names of the classes of net assets have been changed, and the two classes of restricted net assets aggregated into one class of net assets, the composition of the classes of net assets has not changed.

Changes to the statement of activities

The proposal related to the statement of activities represents significant changes and, if enacted, would result in dramatic differences from the current presentation for most NFP entities. The changes are designed to improve NFP financial reporting by:

- Providing information about revenues and expenses that are directly related to an NFP’s mission

- Providing information about an NFP’s ability to meet its current obligations

- Improving comparability of financial reporting for all NFPs, particularly within individual NFP industry segments

The FASB endeavors to accomplish this by requiring all NFPs to present a statement of activities that has two major sections as follows:

- An operating section which includes:

- REGL without donor imposed restrictions and before transfers

- The effects of transfers

- An other-activities (non-operating) section

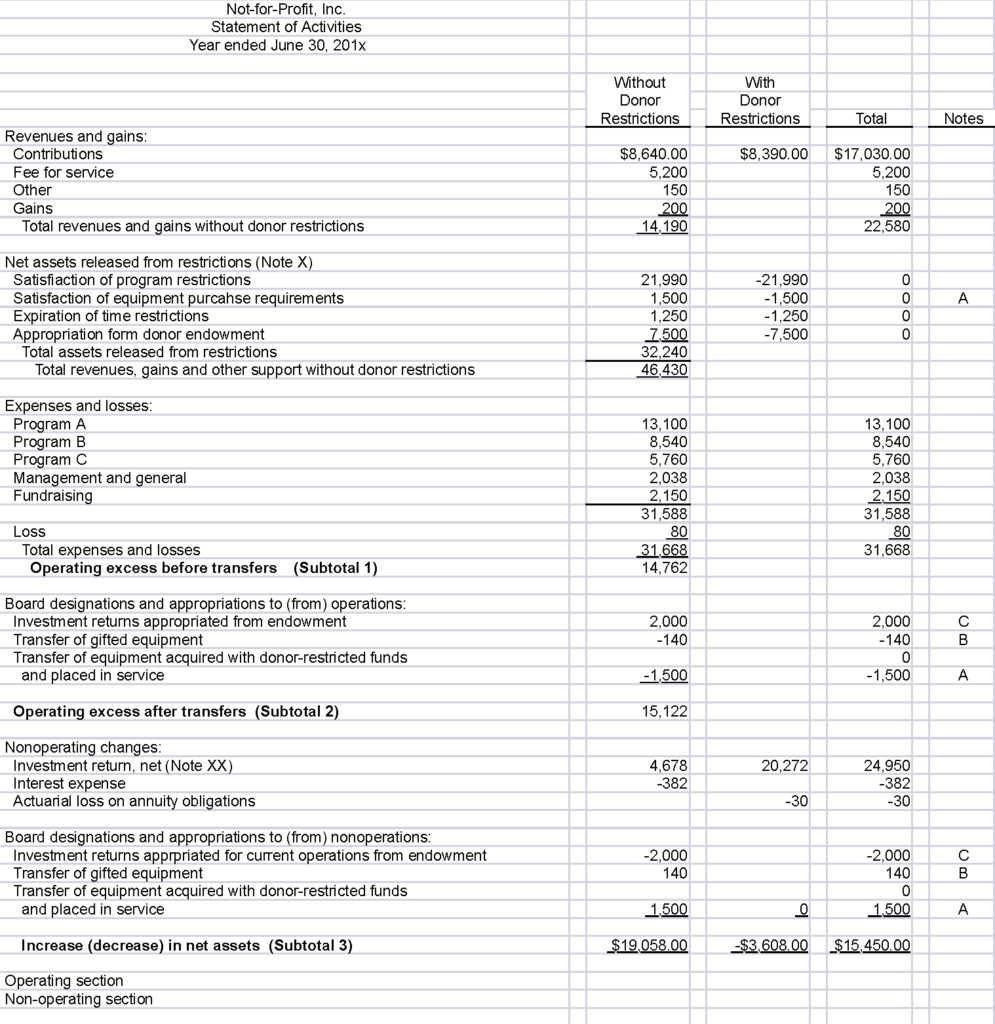

An outline of the statement of activities follows:

Operating changes in net assets:

| Revenues and gains (disaggregate as appropriate) |

| Net assets released from restrictions |

| Expenses and losses |

| Subtotal 1: operating excess (loss) before transfers |

| Transfers in |

| Transfers out |

| Subtotal 2 : operating excess (loss) after transfers |

Non-operating changes in net assets:

| Revenues, gains expenses and losses (disaggregate as appropriate) |

| Transfers in |

| Subtotal 3: Increase (decrease )in net assets |

| Net assets, beginning of the year |

| Total: Net assets, end of year |

The statement of activities can present changes in assets with and without donor restrictions in either a multi-column format or in a layered format.

The classification of REGL between the two main sections would be based on an NFP’s mission and availability. Those items of REGL that are directly related to an NFP’s mission (for example program service fees and related expenses) would be included in operating activities. Those items of REGL that are not related to an NFP’s mission (for example, non-programmatic investment income and attendant expenses) would be included in non-operating activities.

Different NFPs have different missions, and therefore the classification of an item of REGL may differ from one type of NFP to another (but generally should be the same for NFPs within a common industry segment). For example, an NFP whose mission is to promote business within a community through the issuance of loans would record its interest income in the operating section of the statement of activities. On the other hand, an NFP that provides drug counselling services would most likely record its investment income in the non-operating activities section of the statement of activities.

The operating section of the statement of activities

The operating section of the statement of activities is to present all REGL that

- a) result from the NFP’s mission and

- b) are available for current period activities.

Contributions without donor restrictions that are related to an NFP’s mission are recorded in the operating activities section. If those contributions are not immediately available for use they would then be transferred out of the operating activities section to the non-operating activities section.

This is accomplished by presenting two separate subtotals. The first subtotal (subtotal 1 above) represents REGL without donor imposed restrictions and before internal transfers. The second subtotal (subtotal 2 above) will show the effects of transfers on operating income.

Transfers represent amounts that are made available or unavailable for current operations at the discretion of management of the NFP.

Subtotal 2 above represents the change in net assets without donor restrictions from operating activities.

As an example of this presentation:

Assume a donor makes a $100 contribution without restrictions to NFP A. Further, assume that management designates the $100 to be included in its Board endowment. NFP A would present the $100 in the first subtotal of operating activities – REGL without donor restrictions and before transfers. The second subtotal of the operating section of the statement of activities would reflect a $100 transfer of the donation out of operating activities resulting in no net availability of funds from operations as a result of the donation.

The ASU requires certain minimum levels of disclosures. For example, an entity would have to present, at a minimum, aggregated transfers in and aggregated transfers out separately. If detailed information about transfers is not presented in the statement of activities, such information would need to be presented in the notes to the financial statements.

Availability of funds is the overarching principle which will determine the classification of REGL transactions within the subtotal before transfers and after transfers.

The other-activities (non-operating) section of the statement of activities

This section will contain all items of REGL that are not directly related to the NFP’s mission. For example, investment income, other than programmatic investment income, would be included in this area for most NFPs. External and internal investment expenses (netted against the applicable investment income) would also be presented in this section. Revenues (losses) from a for-profit enterprise that is not related to the NFP entity’s mission is another example of an item that would be included in this section. Amounts transferred out of the operating section would be another type of transaction recorded in the other-activities section.

Programmatic investing is defined as the activity of making loans or other investments that are directed at the NFP’s purpose for existence rather than investing in the general production of income or appreciation of the asset. Thus, an NFP that has a program activity that lends money to qualified individuals for scholarships would most likely record the interest income on those loans within the operating activities section of the statement of activities. On the other hand, investment income earned on idle funds would be presented in the other activities section of the statement of activities.

Following is a statement of activities taken from the ASU which illustrates the major points discussed above. It presents donations without and with donor restrictions in a columnar format and items of REGL in the two operating sections and the non-operating section.

Reporting gifts of property and equipment

The proposed ASU makes the following changes in the way an NFP reports gifts of property and equipment in the statement of activities:

- A donor imposed restriction on a gift of cash or other assets to be used for the purchase of property and equipment would be reported as expired when the property or equipment is put in service, absent any explicit donor-imposed requirement to use the asset for a specific period of time or purpose. NFPs would no longer be permitted to relieve the restriction over the life of the asset.

- A donor imposed restriction on a gift of cash or other assets to be used for the purchase of property and equipment that also contains a time or purpose restriction would be reported as expired when the property or equipment is put in service and the time and purpose restrictions are met. The expiration of those restrictions would first be reported in the subtotal operating excess (loss) before transfers and then reported as a transfer out to non-operating activities.

- A gift of property or equipment without donor restrictions would be recorded at fair value in the operating activities section of the statement of activities and be included in the operating excess (loss) before transfers. If the NFP elects to retain the property and equipment for use in operations (versus selling it and obtaining cash), the fair value of the equipment would also be recorded as a transfer out of operating activities and included in the subtotal operating excess (loss) after transfers and as a transfer in to the non-operating activities section of the statement of activities.

Changes to the statement of cash flows

The proposed ASU mandates the use of the direct method of reporting changes in cash flows. Commercial entities currently have no such requirement. At the same time, an NFP will not be required to present the reconciliation of operating cash flows to net income which is required for a commercial entity electing to use the direct method of cash flow reporting.

In addition, the ASU defines operating, financing and investing activities specifically for NFPs, and those definitions will differ from the definition for commercial entities. This will result in differences between the reporting of a similar transaction in an NFP’s statement of cash flows versus the way the same transaction would be reported in a commercial entity’s statement of cash flows.

For example, the ASU specifies the following types of transactions as operating cash flows for an NFP. Italicized items represent transactions which would be reported differently by a commercial entity in its cash flow statement:

- Receipts from the sale of property and equipment or other productive assets

- Cash contributions with donor-imposed restrictions limiting the cash to the purchase of long-lived assets

- Cash purchases of long-lived assets

- Cash outflows and inflows related to programmatic investing

- Cash flows form purchases and sales of collection items (whether or not the collection is capitalized)

- Cash received and paid from agency transactions (may be reported net or gross)

The ASU also identifies the following financing cash flows of an NFP that differ from the classification in a commercial entity’s statement of cash flows:

- Cash payments to creditors for interest

- Cash contributions restricted to long-term, non-programmatic investing

In the case of a consolidated financial statement, the classification of transactions within the statement of cash flows will depend on whether the reporting entity is an NFP or a commercial entity. For example, an NFP entity that consolidates a for-profit entity will follow NFP presentation requirements when preparing its consolidated cash flow statement.

Reporting expenses

Under the proposed ASU, many NFPs will be required to report more expense information than previously required. The proposed ASU eliminates the requirement for voluntary health and welfare organizations to present a statement of functional expenses. In its place, all NFPs will present information about all expenses in one place in the financial statements. Further, operating expenses must be presented by both their functional and natural classification. This requirement extends to items of expense that are included in cost of goods sold and other activities, such as the costs of special events.

That presentation can be within the statement of activities, in the notes to the financial statements or in a separate financial statement (which presumably will not be called a statement of functional expenses.)

There is no requirement to present non-operating expenses by functional classification, although this is not precluded. External and direct investment expenses are netted against investment return and need not be presented. However, there would need to be separate disclosure of the amount of internal salaries and wages that were netted against investment returns and therefore not included in the presentation of expenses.

Investment expenses netted against investment return in the operating activities section do not need to be presented by function.

The ASU stipulates that activities that represent direct conduct or direct supervision of program or supporting activities would require allocation between the program and supporting activities. In addition, activities or costs (for example information technology) may benefit more than one activity and would therefore require allocation between program and supporting activities. NFPs would be required to disclose the method used to allocate expenses between program and supporting functions.

Underwater funds

The proposed ASU changes the current treatment and disclosures related to underwater funds.

First, the deficit related to underwater funds would be reported as part of net assets with donor restrictions. Currently, the amount by which donor restricted endowments are underwater is reported as part of unrestricted net assets. This change is a result of the provisions of UPMIFA which enable management to invade, at least on a temporary basis, endowment corpus.

Second, entities would be required to disclose the following information in the notes to the financial statements, in the aggregate, for all donor restricted endowment funds:

- The fair value of the underwater endowment funds

- The original endowment gift or level required by donor stipulations or law

- The difference between 1 and 2

This will enable the financial statement user to determine the severity of the underwater amount – information that is currently not available in an NFP’s financial statement. For example, underwater amounts of $50,000 each on two separate funds are likely to be viewed differently by financial statement users if one fund has a required corpus of $1,000,000 and the second fund has a required corpus of $250,000.

As a further example, assume a permanently restricted endowment fund had an original principal balance of $1,000,000 and that, as of the financial statement date, the fund had a required balance of $1,160,000 based on the NFP’s accumulation policy. If the endowment fund had a fair value of $1.1 million as of the reporting date, the entity would disclose the $1.1 million fair value, the $1.16 million required endowment level and the $60,000 shortfall (or underwater position). The $60,000 underwater position would be presented within the net assets with donor restrictions in the statement of financial position.

Third, an NFP would be required to disclose its interpretation of its legal ability to spend from underwater funds as well as the internal policy related to spending from underwater funds.

Healthcare entities

The proposed ASU removes the current requirement that business-orientated healthcare organizations present a performance indicator in the statement of activities.

NFP healthcare entities would be required to present a statement of activities that presents an operating activities and other activities section in accordance with the requirements of NFPs in general. For-profit healthcare entities are encouraged, but not required to, present information in the statements of activities similar to the NFP presentation.

NFP healthcare entities would have to utilize the direct method of reporting cash flows. Operating, financing and investing cash flows for NFP healthcare entities would be defined the same as for all other NFPs.

Investment income

Investment income would be reported net of expenses and would be recorded in the operating activities or other activities section of the statement of activities based on the mission and availability principles.

Investment income from programmatic investing activities would be reported in the operating activities section of the statement of activities. All other investment income would be included in the other activities section of the statement of activities.

While there is no requirement to disclose investment expenses in general, the amount of any internal salaries and wages netted against investment income would have to be separately disclosed in the notes to the financial statements.

How Can We Help?