Having previously discussed fraud schemes, trends, and fraudster characteristics identified in the ACFE’s Occupational Fraud 2022: Report to the Nations1, we now shift our focus to identifying the industries with the highest fraud risk and how all organizations can safeguard themselves from fraud and investigate any suspected incidents of fraud.

It is essential for organizations to prioritize fraud awareness and internal controls to minimize the risk of fraud. Having employees well-trained in internal controls and fraud prevention will help minimize the duration and damage of any fraud, especially in smaller organizations where the impact of fraud is significantly greater than in larger organizations.

Smaller Organizations = Greater Loss

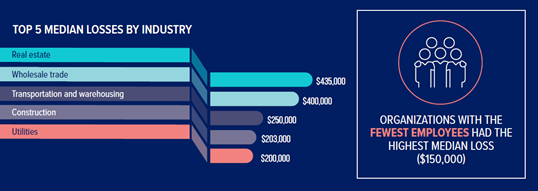

According to the U.S. Small Business Administration, in 2022, the number of small businesses reached 33.2 million, making up a staggering 99.9% of all U.S. businesses operating in 2022.2 While the U.S. Small Business Administration considers firms with less than 500 employees as small businesses, the ACFE categorizes small organizations as those with fewer than 100 employees.3 Unfortunately, smaller organizations are more susceptible to fraud schemes because they tend to operate in a more casual fashion, and as such do not have the same level of internal controls as their larger counterparts. In 2022, small organizations suffered a median loss of $150,000 from fraud.4 In contrast, mid-sized organizations with 1,000 to 9,999 employees accounted for 29% of the ACFE case studies, with a median loss of $100,000.5 The impact of fraud is not only more damaging to small organizations, but it is also harder to recover from. Therefore, it is essential to recognize that fraud impacts organizations of all sizes and that taking preemptive measures, such as implementing anti-fraud controls, can help minimize the opportunity for fraud.

Industry Matters

The occurrence of fraud is not limited to any particular industry, and the ACFE report confirms that fraudulent activities are prevalent in all sectors. However, the report also highlights certain industries that are more susceptible to fraud. These industries could be more vulnerable due to several factors such as the nature of the industry, lack of proper regulations, or the complexity of their operations.

For instance, the real estate industry has the highest median loss of $435,000 per case.6 In contrast, bank and financial services had a much lower median loss of $100,000 per incident, but fraud occurred at significantly higher rates, with 351 cases reported.7The following industries had the highest number of cases reported8:

- Banking and Financial Services – 351 cases, median loss of 100,000

- Government and Public Administration – 198 cases, median loss of $150,000

- Manufacturing – 194 cases, median loss of $177,000

- Health Care – 130 cases, median loss of $100,000

Industries with higher incidences of fraud should be proactive in their approach to prevent fraud. Implementing fraud control measures such as fraud risk assessments, monitoring suspicious activity, and educating employees about fraudulent activities, can help prevent fraudulent activities.

Anti-Fraud Controls and Fraud Awareness – The Dynamic Duo

It is no surprise that 49%, nearly half of the fraud cases surveyed in the ACFE report, occurred because the organization either lacked internal controls entirely, or had inadequate controls.9 Given the unique operations of each organization and the increasing prevalence of remote work and cloud computing, it is crucial to adapt controls to align with the specific needs of each organization. Some of the most effective, and easiest controls to implement include:

- Segregation of duties: Separating duties such as payment approvals and bank deposits prevent one person from having complete control over a transaction.

- Mandatory vacations: Requiring employees to take mandatory vacations allows for fraud schemes to be uncovered.

- Regular audits and review: Regularly reviewing and analyzing financial and operational data helps ensure that transactions are accurate, complete, and documented.

- Staff training: Staff training in fraud detection, prevention, and reporting, helps create a culture of awareness wherein fraud can be minimized and reported if it occurs.

- Whistleblower hotline/email: Establishing a secure, confidential way for employees to report suspected fraud or other unethical behavior is an important component of an anti-fraud program.

The advantage of employing controls becomes apparent quickly. In fact, implementing proactive data monitoring/analysis for only eight months reduced the detection time by 56%, resulting in a 47% reduction in losses.10

The effectiveness of control measures can also be enhanced when employees are trained in fraud awareness. For instance, providing training to employees increased the number of tips and reports to whistleblower hotlines, resulting in faster detection and less damage.11

How Withum Can Help

Internal Controls Review

Are your control measures strong enough to protect your organization from fraud? At Withum, we understand that fraud can have a devastating impact on an organization’s reputation and financial stability. That is why our Systems and Process Assurance Services Team offers a comprehensive review of your internal controls to determine their effectiveness in preventing and detecting fraud.

Our approach involves a detailed analysis of your organization’s financial systems and processes, including risk assessments, transaction testing, and control evaluations. Our services go beyond simply identifying weaknesses. We collaborate with you to implement practical solutions that reduce your organization’s exposure to fraud and improve your overall financial security. Whether you are a small business or large corporation, our team has the experience and expertise to help you safeguard your assets.

Forensic Investigations

If you suspect your organization is a victim of fraud, our Forensics, Investigations, and White-Collar Criminal Defense Team is here to help. Our diverse team of forensic accountants, licensed investigators, digital forensics experts, and data analytics specialists have decades of investigative experience and includes former FBI Agents and professionals with well-respected credentials including Certified Public Accountants (CPA), Certified Fraud Examiners (CFE), Certified in Financial Forensics (CFF), and many others. Whatever your needs, our forensic team has the specialized expertise and experience to help.

At Withum, we take fraud seriously. Do not wait until it is too late to protect your organization from fraud. Contact us to schedule a consultation and learn how our team can help you protect your organization from the damaging effects of fraud.

Authors: Justin Sacks, CPA, CFE | [email protected] and Jen Rodriguez, MAcc | [email protected]

Contact Us

Contact Withum’s Forensics, Investigations and White-Collar Criminal Defense Team to schedule a consultation and learn how we can help you protect your organization from the damaging effects of fraud.