In July 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standards Updated (ASU 2015-12), titled Plan Accounting. This ASU is effective for defined benefit pension plans, defined contribution pension plans and health and welfare plans.

The purpose of this ASU is to reduce the complexity in employee benefit plan accounting. The ASU has three parts, which are as follows:

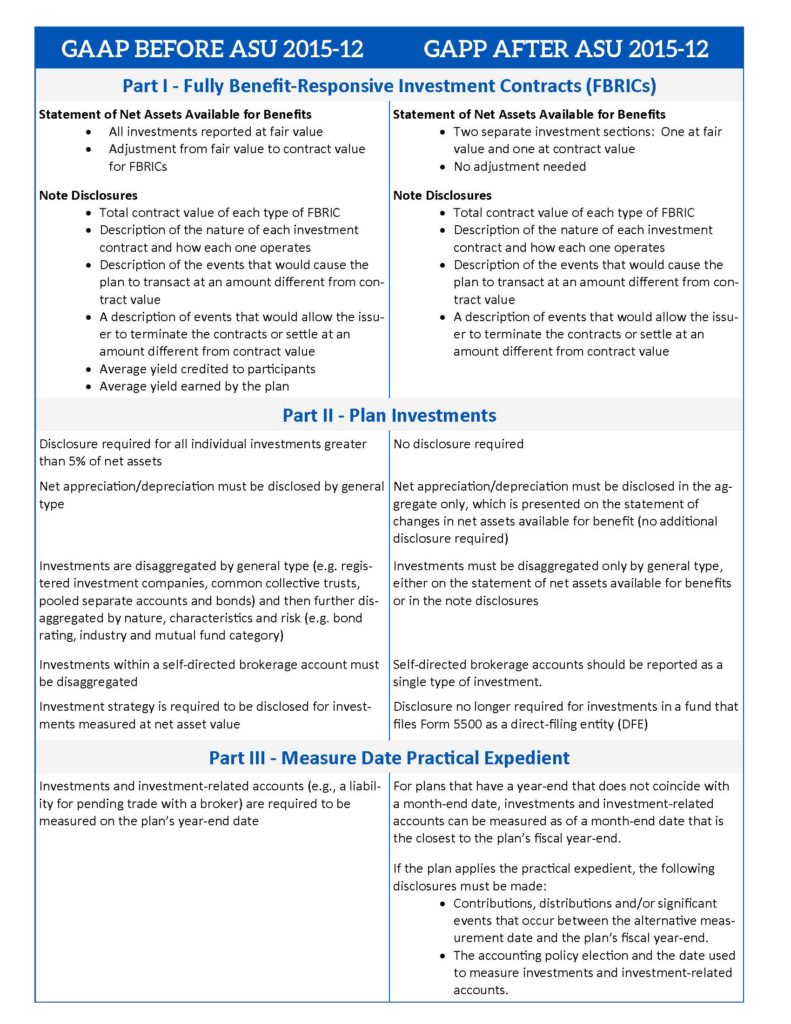

- Part I – Fully Benefit-Responsive Investment Contracts (FBRIC)

- Part II – Plan Investment Disclosures

- Part III – Measurement Date Practical Expedient

The effective date for this ASU is plan years beginning after December 15, 2015. Parts I and II should be applied retrospectively and Part III should be applied prospectively. Plans can early adopt any of the three parts without adopting the other part(s). The nature and reason for the change in accounting principle is required to be disclosed in the period of adoption.

Changes to Benefit Plan Financial Statements under ASU 2015-12

The chart below details generally accepted accounting principles (GAAP) before ASU 2015-12 and after the implementation of ASU 2015-12.

If you have any questions, please contact us by filling in the form below.

Author: Lisa Galinsky, CPA | [email protected]

How Can We Help?