Potential Tax Savings for IC-DISCs

Tax Benefit

- 15.8% permanent tax savings on export profits by converting ordinary income into qualified dividend income (subject to NIIT).

How Does an IC-DISC Work?

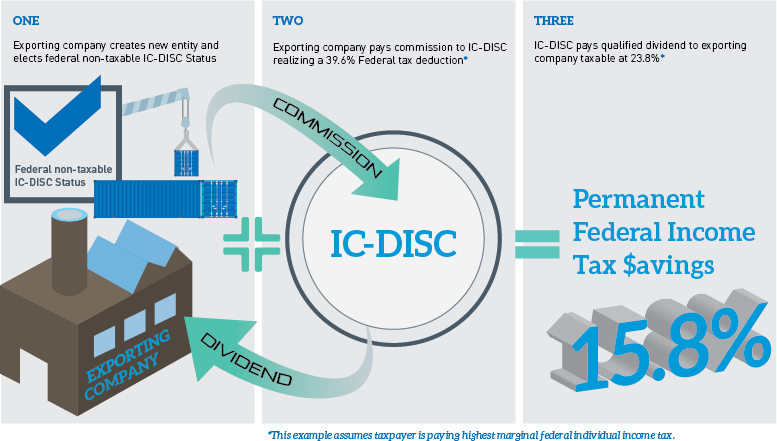

- Owner-managed exporting company qualifies for and creates a tax-exempt IC-DISC

- Exporting company pays IC-DISC a commission on the sale of qualified export property

- Exporting company deducts commission from ordinary income taxed at rates up to 39.6%

- IC-DISC pays no tax on the commission income

- Shareholders of an IC-DISC must pay income tax on dividends at qualified rates

up to 23.8% - Results in a 15.8% permanent tax savings

What Profits Qualify for Savings?

- The property must be partly manufactured, produced, grown or extracted in the United States:

- conversion cost incurred in the U.S. constitute 20% of COGS

- there is substantial transformation in the U.S.

- the operation in the U.S. are generally considered manufacturing

- The property must be sold for direct use outside the U.S.

- The property must have a maximum of 50% foreign content

Who Qualifies for the IC-DISC?

- Manufacturers & distributors that directly export their products

- Manufacturers & distributors that sell products that are destined for use overseas

- Architectural and engineering firms who work on projects that will be constructed abroad (even though the work is performed in the United States.)

- Pass-through entities and privately held corporations

IC-DISC Illustration – a Three Step Process

Next Steps

The potential tax savings can help export companies be more competitive in the global marketplace and provide additional cash-flow to improve working capital. If you have any questions regarding IC-DISCs, please reach out to a member of Withum’s International Tax Services Team at [email protected].

To ensure compliance with U.S. Treasury rules, unless expressly stated otherwise, any U.S. tax advice contained in this communication is not intended or written to be used, and cannot be used, by the recipient for the purpose of avoiding penalties that may be imposed under the Internal Revenue Code.