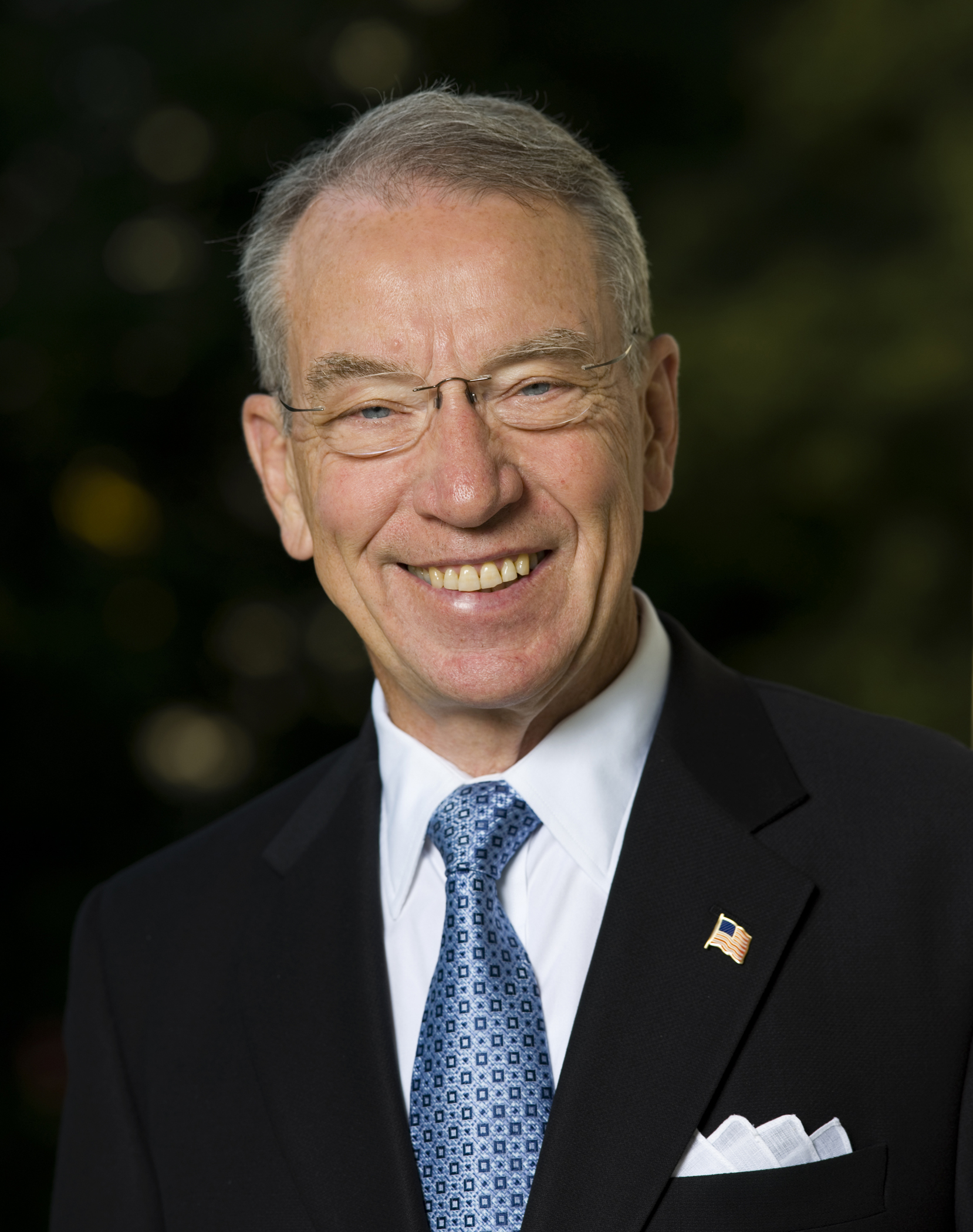

Senator Grassley Awaits IRS Updates on Nonprofit Hospital Reforms

He has served in various key positions in the U.S. Senate, including, but not limited to, Chairman of the Senate Finance Committee and Chairman of the Senate Judiciary Committee. He has also served on the Agriculture, Nutrition, and Forestry Committees as well as the Joint Committee on Taxation.

Grassley has participated in a variety of bipartisan legislation. Serving as the current Chairman of the Judiciary Committee of the 114th Congress, he has held ninety-nine hearings and reported thirty bills. Twenty-four of these bills were passed by the Senate of which seventeen were subsequently signed into law.

Grassley on Charity Care & Community Benefit

It is no secret that Senator Grassley has spent a substantial amount of time focusing on nonprofit, tax-exempt organizations. He has stated that his goal is to “help improve accountability and good governance so tax-exempt groups maintain public confidence in their operations.” Over the course of his tenure in office, Grassley has contributed to and participated in various efforts highlighting the public value of tax-exempt status.

It is no secret that Senator Grassley has spent a substantial amount of time focusing on nonprofit, tax-exempt organizations. He has stated that his goal is to “help improve accountability and good governance so tax-exempt groups maintain public confidence in their operations.” Over the course of his tenure in office, Grassley has contributed to and participated in various efforts highlighting the public value of tax-exempt status.

In 2007, Grassley proposed increased requirements for charity care as a means of preserving hospitals’ tax exemption. His goal was to hold nonprofit hospitals “more accountable for the billions of dollars in annual tax exemptions they enjoy.” The proposed legislation would have required nonprofit hospitals, among other things, to spend a minimum amount on free care for the poor, also known as charity care, and set curbs on executive compensation and conflicts of interest.

Although the proposed requirements were never federally enforced, healthcare systems today understand that enforcement in the future is not out of the question.

Grassley on Financial Assistance

In 2016, Grassley began an investigation of Mosaic Life-Care, a tax-exempt hospital located in Missouri, for its debt collection practices and increasing lawsuits against low-income patients. The investigation resulted in the forgiveness of $16.9 million in debt for patients previously placed in collection. Shortly thereafter, Grassley investigated Deaconess Hospital of Indiana, another tax-exempt hospital, for filing over 20,000 lawsuits against its patients from 2010 through 2015. This investigation resulted in changes to the Deaconess’ financial assistance policy (“FAP”) which included, but was not limited to, lowering the income threshold of qualifying patients and allowing free or discounted care to eligible individuals.

In 2016, Grassley began an investigation of Mosaic Life-Care, a tax-exempt hospital located in Missouri, for its debt collection practices and increasing lawsuits against low-income patients. The investigation resulted in the forgiveness of $16.9 million in debt for patients previously placed in collection. Shortly thereafter, Grassley investigated Deaconess Hospital of Indiana, another tax-exempt hospital, for filing over 20,000 lawsuits against its patients from 2010 through 2015. This investigation resulted in changes to the Deaconess’ financial assistance policy (“FAP”) which included, but was not limited to, lowering the income threshold of qualifying patients and allowing free or discounted care to eligible individuals.

These specific instances have motivated Grassley to investigate additional nonprofit hospitals in an effort to review and reform charity care, financial assistance and billing and collection practices.

Request to IRS for Updates on Nonprofit Hospital Reform

After the early 2016 investigations of the above tax-exempt hospitals, Grassley requested updates from the Commissioner of the Internal Revenue Service (“IRS”) by way of a letter dated June 9, 2016.

In his letter to IRS Commissioner John Koskinen, Grassley requested updates on the IRS’ implementation of Internal Revenue Code (“IRC”) §501(r). Grassley’s letter concluded by asking Koskinen to address the following questions, in an attempt to help Grassley “better understand the effect of these provisions”:

- Since the FAP and billing and collection provisions became effective, how many nonprofit hospitals has the IRS found to be out of compliance with these two requirements? Please identify whether the hospital was out of compliance with FAP requirements, billing and collection requirements, or both, as well as whether the noncompliance was determined to be willful and/or egregious or minor and/or inadvertent; and

- What, if any, enforcement action has the IRS taken against nonprofit hospitals found to be out of compliance with either the FAP or billing and collection provisions? In responding to this question, please indicate the number of hospitals associated with each type of enforcement action, such as whether they were permitted to take corrective action to rectify the non-compliance, had their tax-exempt status revoked, or any other action that may have been taken.

Additionally, the nonprofit hospital reforms also required the IRS and Department of Health and Human Services to collect information on nonprofit hospitals and provide an annual report to Congress. The first report entitled “Report to Congress on Private Tax-Exempt, Taxable, and Government-Owned Hospitals, was issued in January of 2015 and contained information related to the 2011 calendar year.

In Grassley’s letter, he mentioned that “at this time, the IRS has yet to issue a 2016 report covering calendar year 2012” and requested the IRS provide an update as to the status of the 2016 report, including a timeline of when Congress can expect to receive it. Grassley concluded by requesting a response in two weeks’ time in addition to ongoing communication regarding the IRS’ efforts to monitor the fulfillment of tax code obligations by nonprofit hospitals.

Response from the IRS

Although the IRS has not provided a formal response to Grassley’s letter, IRC §501(r) was addressed in the IRS’ FY 2017 Work Plan (“Work Plan”) released on September 28, 2016.

The Work Plan described the ongoing review of hospitals and their requirements under the Patient Protection and Affordable Care Act (“ACA”). The Work Plan stated that, as of June 30, 2016, 692 hospitals were reviewed to ascertain compliance with these additional requirements and 166 hospitals were referred for field examination. The Work Plan noted that the IRS will continue to make the IRC §501(r) compliance review a priority in 2017.

Conclusion

Despite the recent focus on the repeal of the ACA, President Trump’s first Executive Order, many believe IRC §501(r) is here to stay. Grassley has been a long-time advocate for low-income, uninsured and underinsured patients. He co-authored this section of the ACA in his pursuit in advocating for transparency in hospital billing practices.

In his letter to Koskinen, Grassley stated “we can both agree that many charitable hospitals perform good work on behalf of the communities that they service. However, some charitable hospitals get as close to the line as possible, while others callously breach it. It is important that Congress, via its oversight role, and the IRS ensure that charitable hospitals are functioning as intended.”

As Grassley and the rest of the tax-exempt hospital community wait for an IRS update with respect to IRC §501(r) compliance, it has become increasingly important that hospitals make compliance a top priority. Failure to comply with the aforementioned requirements may result in several unfortunate consequences including audits, investigation, corrections, excise taxes, public disclosure of violations and potential loss of tax-exempt status.

Ask Our Experts

To ensure compliance with U.S. Treasury rules, unless expressly stated otherwise, any U.S. tax advice contained in this communication is not intended or written to be used, and cannot be used, by the recipient for the purpose of avoiding penalties that may be imposed under the Internal Revenue Code.