There are a number of quantitative and qualitative methods for calculating a DLOM. Appraisers should familiarize themselves with all of these methods, and employ the one that existing guidance recommends as most reliable for a given purpose. Empirical studies, for instance, should rarely be soley relied on when selecting an applicable DLOM. Further, restrictions on the transferability of the security itself being valued should be considered, as opposed to entity level restrictions.

A description of the various methods is beyond the scope of this article, but given the level to which the Finnerty model has been employed by firms large and small, we thought we’d focus on a popular model used to estimate DLOMs.

The Finnerty model is often used to estimate marketability discounts.1 This model uses an arithmetic average strike, put option. The strike price is based on the predetermined period average value of the underlying asset. The AICPA Guide2 describes the Finnerty model in the following manner:

John Finnerty proposed a model that assumes the investor does not possess special market timing ability and would be equally likely to exercise the hypothetical liquid security at any given point of time. The value of marketability is modeled as the present value of cash flows, similar to an average-strike put option. The Finnerty method addresses the issue of assuming perfect market timing in the Longstaff method and the issue of assuming protection on the downside while still realizing appreciation on the upside in the protective put method. Finnerty also performed a regression analysis to restricted stock studies, adjusting to remove other significant factors, such as concentration of ownership and information effects, and found that after isolating the marketability-related factors, the discounts predicted by his method are consistent with the data.

No approach is perfect at estimating the DLOM. The Finnerty model can under-estimate downside risk and under-appreciate upside potential.

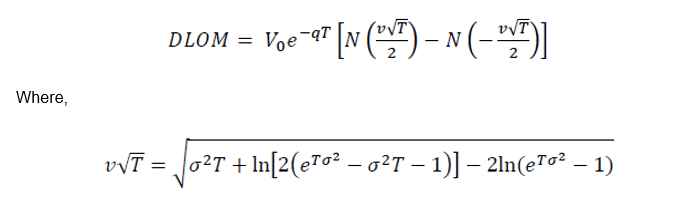

The following is the formula for calculating DLOM using the Finnerty Model:

And the key assumptions used in the Finnerty model:

Term, the assumption of Geometric Brownian Motion of the underlying’s value, and volatility are all highly subjective assumptions. As the author notes, based on his regression analysis

“…the model appears to fit actual marketability discounts reasonably well, although not perfectly. There is a tendency for the model to understate the discount when the volatility is less than 45 percent and greater than 75 percent and to overstate it when the volatility is between 45 percent and 75 percent. It also appears to be somewhat less accurate for longer restriction periods for very high-volatility stocks.”

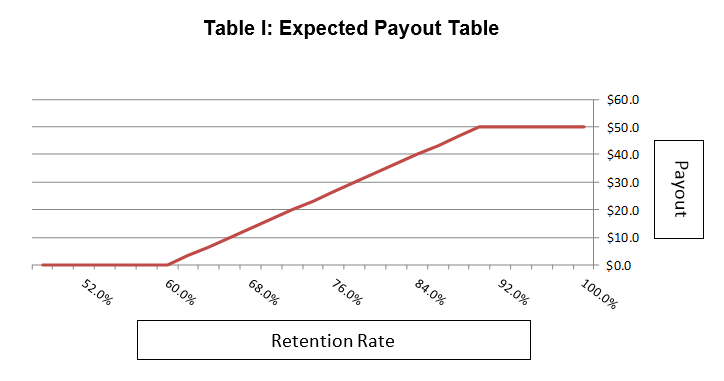

The following table contains the results of the Finnerty model at various term lengths and volatilities (holding the risk free rate and dividend assumption constant).

Table I: Finnerty Sensitivity Analysis

Often appraisers are interested in capturing all appropriate discounts as dictated by guidance applicable to the selected standard of value. The selection of the Finnerty model to calculate a DLOM is not without its issues; perhaps most notably, that the model never produces a discount greater than 32.3%.

Conclusion

Selection of a reasonable method for calculating a discount for lack of marketability depends on the facts and circumstances surrounding the valuation, the intended user and published guidance appropriate to the method and valuation purpose. The Finnerty model is generally accepted as calculating a reasonable DLOM, but the appraiser should rely on guidance related to the facts and circumstances of the valuation before selecting.

How Can We Help?

For questions or to speak with a member of Withum’s Healthcare Services Group, please contact us by filling out the form below.