The Qualified Opportunity Zone program was passed into law last December as part of the Tax Cuts and Jobs Act. Qualified Opportunity Zones (QO Zones) are federally-recognized areas chosen by local governments that provide investors with favorable tax incentives. QO Zones are made up of low-income census tracts and they cover roughly 10% of the U.S. population.

A host of benefits are available to taxpayers who choose to invest in Qualified Opportunity Funds (“QOF”), which are corporations or partnerships created for the purpose of investing in qualified opportunity zone property. As noted in Code Sec. 1400Z-2, as long as taxpayers reinvest their capital gains within 180 days, taxpayers may defer paying tax on these capital gains until the earlier of December 31, 2026 or the date they sell their investment in the QOF. Below are the rules for the deferral of gains invested in QOF:

- QOF investment held for 5 years – basis increase equal to 10% of the gain in year 5

- QOF investment held for 7 years – additional basis increase of 5% of the gain in year 7

- If the investment is held on a QOF investment on December 31, 2026, the investor will then pay tax on the remaining 85% of the original gain invested into the QOF

- QOF investment held for 10 years – special rule

A taxpayer holding an investment in a QOF for more than 10 years is able to make a permanent exclusion election under Code Sec. 1400Z-2(c). As a result, the basis in the QOF investment will be equal to the fair market value of such investment on the date that the investment is sold or exchanged and any capital gain on the QOF investment will be permanently excluded from taxation. QO Zones are similar to another favorite tax deferral strategy for real estate investors – like-kind exchanges. A few differences between QO Zones and the like-kind exchange rules are:

- Only the amount of the gain (not cost basis) is required to be invested into a QOF to defer the capital gain amount. With like-kind exchanges, the taxpayer must reinvest every dollar to defer all taxation and any cash received would be taxable.

- Investments do not need to be like kind (i.e. a stock investment can be sold for a gain and rolled into a real estate investment in a QO Zone).

- Investments in QO Zones must be in pre-defined, state-designated opportunity zones.

- If, after 10 years, an investment interest in a QOF is sold, the post-acquisition appreciation can be excluded from taxation.

Substantial Improvement

The whole idea of the Opportunity Zones tax law is to connect investor capital with low-income areas of the country that may have the greatest need for reinvestment. Going along with the spirit of the law, IRC Sec. 1400Z-2(d)(2)(D)(i) states that qualified opportunity zone property held by a qualified opportunity fund must satisfy one of the following requirements:

- The original use of qualified opportunity zone property commences with the qualified opportunity zone fund, or

- The qualified opportunity zone fund substantially improves the property

As clarified in the recent Revenue Ruling by the IRS, the term substantially improves means that taxpayers must double their adjusted basis in the property after purchase and during any30-month period that they hold their qualified opportunity zone property. The additions to basis must exceed the adjusted basis in the property at the beginning of such 30-month period. Land is excluded from the adjusted basis calculations.

Example – Redevelopment

QOF A purchased a vacant office building located in a qualified opportunity zone. The QOF purchased the building for $1,000,000. Of the $1,000,000 purchase price, 60% is allocated to the building value ($600,000) and 40% is allocated to the land value ($400,000). Therefore, during any 30-month period, QOF A must substantially improve the property by increasing the adjusted basis in the building by whatever the adjusted basis is at the beginning of the 30-month period. So, for the first 30-month period after the purchase, an additional $600,000 (the amount allocated to the building at the time of purchase) of substantial improvements are necessary. A year after purchasing the building, QOF A spends $750,000 and 15 months to redevelop the building and build out spaces for incoming tenants, thereby satisfying the substantial improvement clause.

In order to satisfy this substantial improvement provision, it may be best to consider real estate investments in qualified opportunity zones in which a development or redevelopment opportunity is the best use of the underlying property.

Layering Opportunity Zone Incentives

It may be beneficial for investors and developers to layer a qualified opportunity zone investment with other federal, state, and local incentives that already exist.

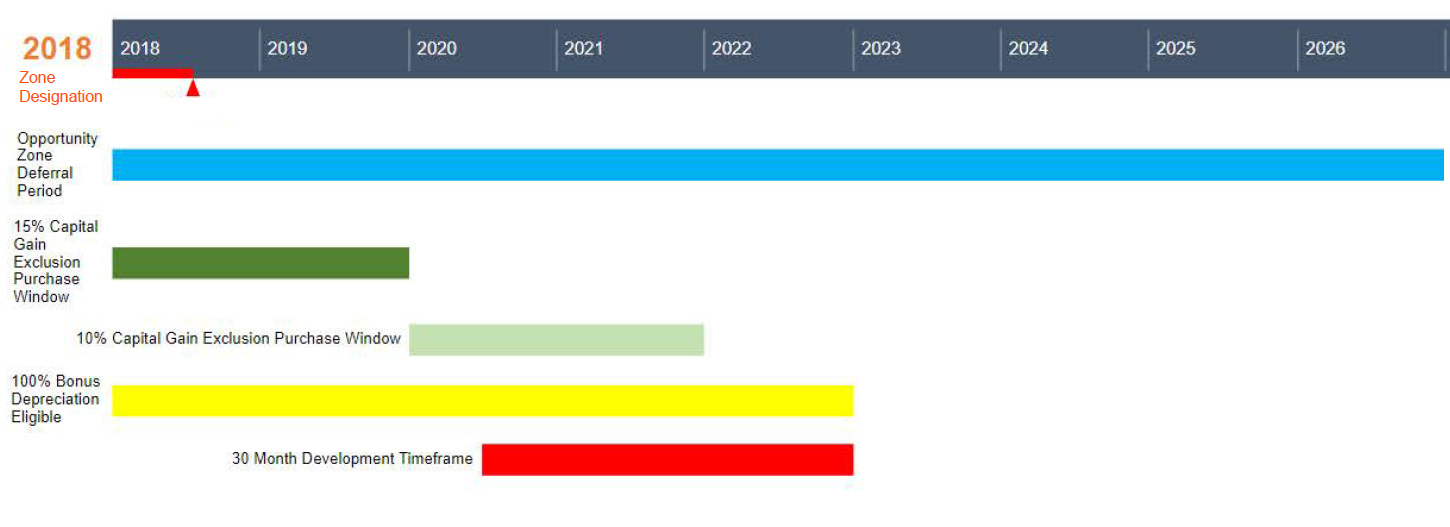

As part of a separate tax law resulting from the recently passed Tax Cuts and Jobs Act, businesses may take 100% bonus depreciation on qualified property placed into service before January 1, 2023. As the chart above shows, a taxpayer may make effective use of the 100% bonus depreciation window in connection with the need to satisfy the “substantial improvement” (doubling of adjusted basis) in any 30-month time period during the opportunity zone deferral period. By overlapping the development/redevelopment/build out costs needed to satisfy the “substantial improvement” clause related to opportunity zone property, taxpayers may see additional benefits by electing 100% bonus depreciation for eligible property.

The above chart also illustrates the 15% and 10% capital gain exclusion purchase windows previously discussed (i.e. If capital gains are reinvested into a qualified opportunity fund on or before December 31, 2019, a taxpayer will receive a 15% exclusion on the original capital gain to be recognized when it comes due on December 31, 2026 (assuming the interest in the QOF is held until then)).

It is important to note that a taxpayer must “substantially improve” (double adjusted basis) the qualified opportunity zone property within any 30-month period – it does not have to be within the first 30 months of purchasing the QOZ property or in the 30-month timeframe shown in the chart above. The chart above is intended solely to highlight the additional benefits to be obtained by substantially improving the property in connection with the window of opportunity for 100% bonus depreciation.

State and Local Incentives

Many states and local governments may have their own pre-existing incentive programs to encourage development, investment, and job creation in low-income areas, such as those that have been designated as qualified opportunity zones.

If a QO Zone investment is being considered in an existing real property, and knowing that the adjusted basis will need to be doubled in any 30-month period, consideration should be given to speaking with local government officials and tax advisors to consider what federal, state, and local incentive programs may be available.

Please reach out to your Withum tax advisor with any questions regarding what qualified opportunity zones are, how the process of investing in a qualified opportunity fund works, or help with setting up a fund.

Author:Dalton DesRoches, CPA | [email protected]

Contact Us

Contact Withum’s team of professionals if you have any questions or concerns.