Navigating the complexities of international taxation requires a comprehensive understanding of evolving regulations and strategic planning. This overview encompasses key aspects of current tax landscapes that are essential for companies operating internationally.

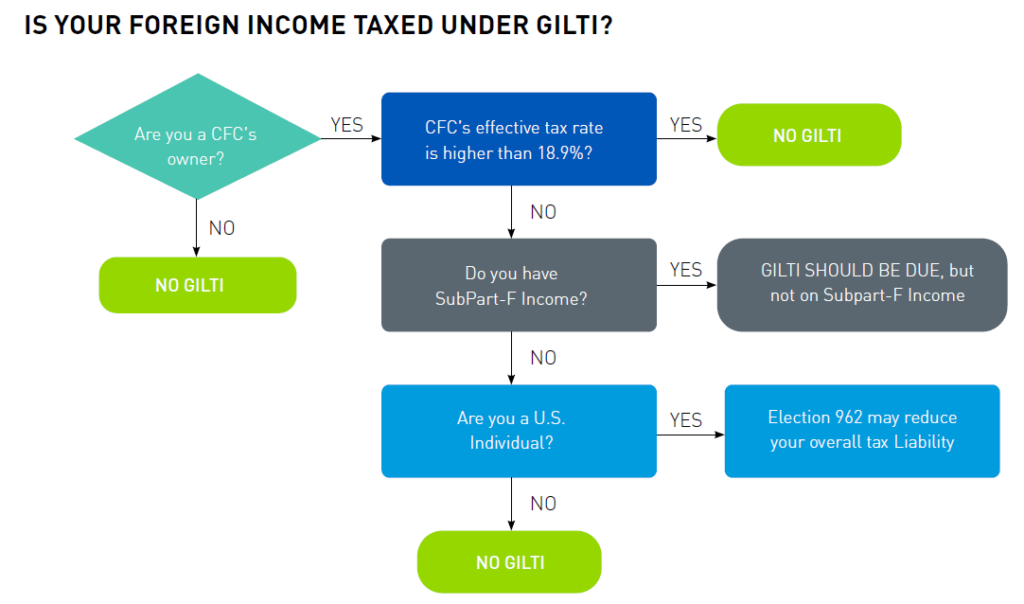

- Taxation on foreign subsidiary income while Subpart F remains in effect.

- Foreign-Derived Intangible Income (FDII): beneficial tax rate of intangible income, available only to corporations.

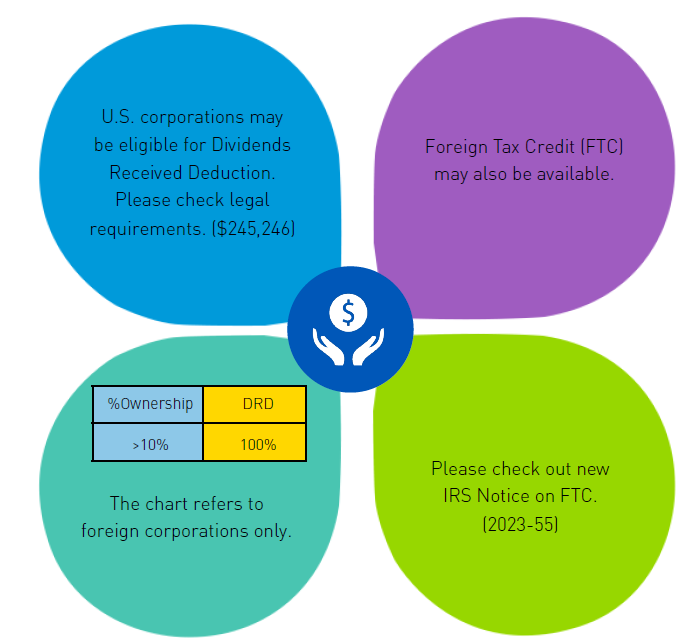

- Foreign Tax Credits (FTCs): you can claim a credit only for foreign taxes that are imposed on you by a foreign country – generally only income, war profits and excess profits taxes qualify for the credit.

- Corporate Transparency Act (CTA): enacted in 2021 and takes effect in 2024. This requires beneficial owner reporting to FinCen to

enhance transparency in entity structures and ownership to combat money laundering, tax fraud, and other illicit activities.

Did You Sell Goods or Services Abroad?

- FDII Deduction: This deduction lowers the U.S. tax rate to 13.125%.

- Indirect Tax Compliance: Non-U.S. registration, VAT or GST collection obligations may be required.

- Withholding Taxes: W8 forms and certificates may be required from non-U.S. persons receiving payments from you.

- Transfer Pricing Documentation: If applicable, be sure to have a robust and updated set of documents.

- Trade Agreements: Certain trade agreements might impact the tariffs applied to exported goods.

2023 Year-End Tax Planning Resources

Withum’s Year-End Tax Planning Resource Center is a one-stop-shop for annual tax planning tips for individuals and businesses, legislative and regulatory changes and other tax-saving opportunities.

Foreign Tax Credit

- The 2022 final foreign tax credits regulations required a detailed analysis of the foreign tax regime to determine creditability, the result of which was onerous and challenging (read more about it here: Let’s Talk: Final Regulation Changes to the Foreign Tax Credit - Withum). These regulations had four aspects to determine creditability of a foreign tax: realization, gross receipts, cost recovery and attribution.

- Temporary relief was released in 2023 for determining eligibility of foreign taxes for U.S. credit purposes. No foreign tax whose base is gross receipts or gross income satisfies the net income requirement, except in the case of a foreign tax whose base consists solely of investment income that is not derived from a trade or business, or wage income (or both). Additionally, taxpayers may disregard the rules regarding the jurisdiction to tax excluded income rule and the source-based attribution requirements promulgated in the final regulations, at least through the year-ended December 31, 2023.

- It is important to note the language provided by the relief precludes foreign digital service taxes from being creditable.

Corporate Transparency Act

- Each “Reporting Company” shall submit to FinCEN a report that identifies each “Beneficial Owner”

- Reporting Company: a domestic or foreign corporation, LLC or “similar entity.” Note there are more than 23 exceptions from

reporting. - Beneficial Owner: an individual who, directly or indirectly, exercises substantial control over the entity or owns or controls 25%

of the ownership interests of the entity. - Entities in existence before January 1, 2024 are required to report by January 1, 2025. Proposed rules require entities created in 2024 to report to FinCen within 90 days of formation.

- Reporting Company: a domestic or foreign corporation, LLC or “similar entity.” Note there are more than 23 exceptions from

- Substantial Penalties for failure to report

Transactions With Related Partners

- What should you know in terms of Transfer Pricing?: Businesses are required to prepare and maintain documentation supporting their transfer pricing positions. This documentation should demonstrate that the intercompany transactions are priced at arm’s length.

- Documentation generally includes: Functional, Comparability, and Economic Analysis: Intercompany agreements, guidelines, and protocols to justify the pricing, risk allocation, and profit level indicators.

- Documentation retention: Keep transfer pricing documentation for about seven years as the IRS may ask for it during audits.

- International tax compliance may be required: You might need to file Form 5471 and related schedules for transactions involving related parties and Controlled Foreign Corporations (CFCs).

- Advance Pricing Agreements (APAs): APAs with the IRS create upfront pricing agreements, reducing transfer pricing dispute risks.

Cash Repatriation

Did Your Organization Adopt a Remote Work Policy?

- Permanent Establishment Risk: While working remotely, your non-U.S. employees may create a taxable presence for your organization in his or her jurisdiction.

- Foreign-Earned Income Exclusion (FEIE): U.S. employees may be eligible for FEIE up to $120,00 (2023). To quality, you must meet the physical presence test or the bona fide residence test.

Taxation of the Digital Economy

On October 8, 2021, 136 countries agreed to implement a global minimum tax of 15%, effectively ending decades of tax competition aimed at luring foreign investment with low-income tax rates.

- The agreement would only impact large multinational companies with $750 million or more in worldwide sales.

- Initially, implementation of the agreement was targeted for 2023. However, few countries have enacted the local legislation required to implement these minimum taxes.

- Many countries have also enacted indirect taxes (VAT/GST) on digital services that are delivered to local customers. Applicability thresholds are generally much lower (e.g., 10,000 Euros of sales), and liability for such taxes may extend to other participants of the service supply chain.

From recent legislation and regulation updates to top considerations for international tax planning and the everchanging digital economy, Withum’s International Tax Services can help you with your year-end planning needs.

Authors: Kimberlee S.P. Murphy, CPA, MBA, Partner | [email protected] and Manpreet Sangha | [email protected]

Contact Us

Reach out to Withum’s International Tax Services Team for guidance as year-end approaches.

Disclaimer: No action should be taken without advice from a member of Withum’s Tax Services Team because tax law changes frequently, which can have a significant impact on this guide and your specific planning possibilities.