Partners’ Network Newsletter January 2012

WithumSmith+Brown, PC

Contact:

Ed Mendlowitz

[email protected]

To our colleagues,

Welcome to 2012. Make it a year of accomplishment. Do not hesitate to reach out to us if you think we could help you. Frank, Peter and I are always available for your questions.

I am very excited about this year’s WS+B Partners’ Network Pre-Tax Season CPE Program. My opening Managing Your Tax Season presentation will have two hours of all new, never before presented material. Not one sentence will be a repeat. I want to WOW! you and will do it with no repetition, three interactive segments, new never before posted checklists, tax season metrics you can use to evaluate your practice, big time services that are easy to assist clients with, and many other surprises. Don’t miss this! I have been doing a Managing Your Tax Season speech for over 30 years, and this is the first time every second of the presentation will be brand new and fresh! This material will not supersede existing material, but will add to it.

Peter, Frank and I know most of the people that will be attending, and we work very hard to present information you won’t get elsewhere. We have been presenting the Pre-Tax Season Program for over twenty years and intend to keep doing it so you will want to keep returning. We are working hard for you and enjoy every minute of it, so come and take advantage of what we have to offer and allow yourself to benefit from it.

The fact that the 5 hour program is free for PN members entices you to keep coming back, but we know that if you didn’t feel it was worth your time, you wouldn’t be coming. The last few years we had over 100 people attend and are glad to be able to present it for our fellow practitioners. In accordance with our policy, PN members can also bring a guest also at no charge.

Peter’s IRS update is one of our most popular programs and because of his activity as one of the tax leaders in our firm and in the NJSCPA, his meetings with IRS officials and attendance at AICPA national conferences, he is on the cusp of what’s happening, and he willingly shares it. Peter also presents technical tax issues that you won’t hear elsewhere.

Brian Lovett and John Daly are returning with procedure, technology, and SALT (state and local tax) updates. We get beat up every year because we don’t let them speak more than 25 minutes each, but those 25 minutes are chock full of real bottom line what’s happening updates. You’ll learn more from each of them in 25 minutes than from most others in an hour and 25 minutes. We want this CPE program to be after the normal business day and five hours is the most we can run it and still get you home at a reasonable hour.

Be sure to sign up today for this valuable Pre-Tax Season CPE program on February 6th. You will also receive a handout that will be valuable reference sources you can refer to in the future.

Cordially,

Edward Mendlowitz

Editor

P.S. We perform many other services for CPAs including peer and quality reviews, business valuations and forensic services, and audits that you may not be in a position to perform. Please keep us in mind when you are in need of these services. We can also lend a hand to controllers who need assistance on special projects including tax basis conversions to GAAP and state tax compliance issues.

Partners’ Network Pre-Tax Season CPE

Monday, February 6, 2012

5PM to 9:50PM (5 CPE)

Forsgate Country Club, Jamesburg, NJ

(Near Turnpike Exit 8A)

| 5:00-5:20PM | Networking dinner |

| 5:20-7:00PM | Managing Your Tax Season Ed will provide updated information on how to better service clients with greater skill, more fun and increased revenues. This program will contain all new and never before discussed material with audience interaction.Ed Mendlowitz, CPA, is the author of the AICPA book: Managing Your Tax Season, Second Edition |

| 7:00-7:20PM | Networking break |

| 7:20-8:10PM | Peter Weitsen’s IRS Update This is an annual treat with the most recent IRS news and procedures and how they affect your clients. Speaker: Peter A. Weitsen, CPA |

| 8:10-8:35PM | State Tax Update What’s new with New Jersey and New York taxes by our Firm’s State Tax Specialist. Speaker: John Daly, MST |

| 8:35-9:00PM | Software & Preparation Procedures Update What is available, why use it, how to use it, and how WS+B uses it. The presentation will include our experiences with tax flow and intelligent scanning software. Speaker: Brian Lovett, CPA |

| 9:00-9:50PM | Tax Changes & Traps When Preparing Returns. This provides up-to-the-minute insights in the tax law changes and highlights of the issues that tend to be overlooked. Speaker: Peter A. Weitsen, CPA |

No charge for Partners’ Network members. $125.00 for nonmembers. Seating limited. Please reply to Heather Suddoth 732.828.1614 or [email protected]

WithumSmith+Brown,PC is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org. For information regarding refund, complaint, and program cancellation policies, please contact Heather Suddoth at [email protected].

Program Level: Basic

Prerequisites: Must be a CPA in own practice or a Partner/Manager in a firm

Advanced Preparation: None

Delivery Method: Group-Live

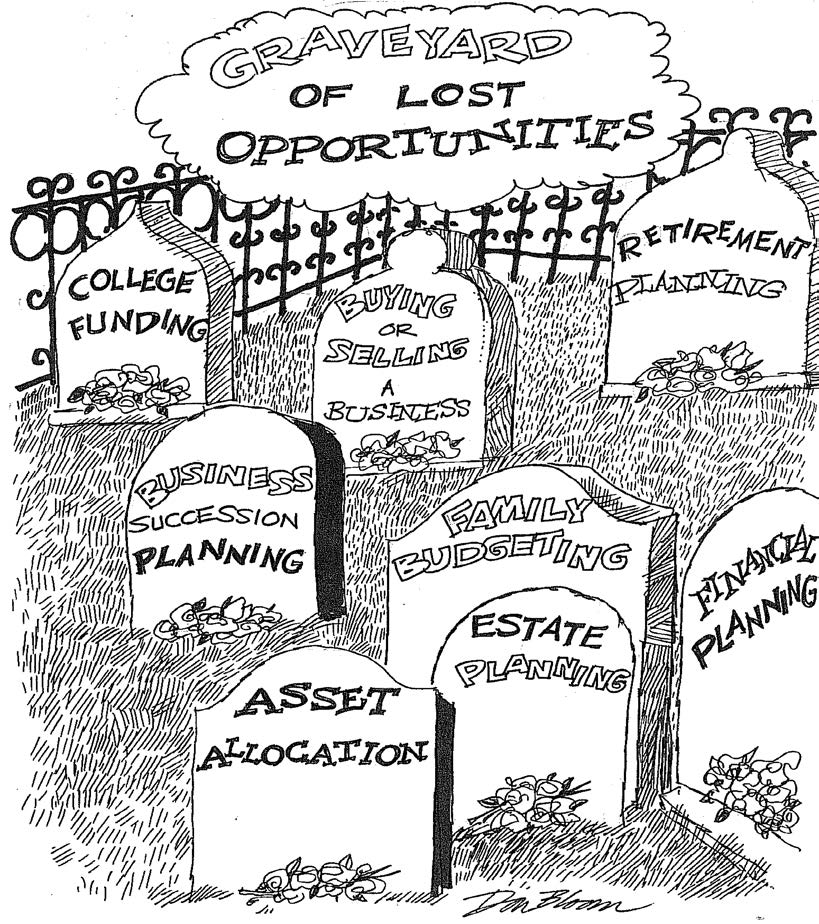

Getting Your Affairs in Order

Presented by Edward Mendlowitz, CPA. Speech February 5, 2012, 10:00AM, at Congregation Beth Ohr, Route 516, Old Bridge, NJ. No charge and no RSVP required. Bagel breakfast and free book distributed to attendees. CPE credits are not available for this presentation.

Presented by Edward Mendlowitz, CPA. Speech February 5, 2012, 10:00AM, at Congregation Beth Ohr, Route 516, Old Bridge, NJ. No charge and no RSVP required. Bagel breakfast and free book distributed to attendees. CPE credits are not available for this presentation.

Interview with Heather Campisi

Heather Campisi is a Marketing Coordinator working out of WS+B’s New Brunswick office and also supports our Silver Spring, MD and Philadelphia, PA offices. Many of our offices have a dedicated marketing coordinator, the smaller offices sharing one. To serve the needs of the individual office on a regular basis, they also work on major projects with the WS+B Marketing Department. Additionally, there is a coordination between all the marketing people to assure the branding and message is consistent and a sharing of techniques and specializations. For instance, marketing people are responsible for the marketing of different niche and service groups, some are graphic designers, and others take control of major firm-wide events. There appears to be a seemless collaboration between the eleven marketing people employed at WS+B with Rhonda Maraziti the Director of Marketing and Practice Growth. Additionally the Firm participates in the Association for Accounting Marketing (“AAM”), a national organization of CPA firm marketing people. Each year the department sends a few from the team to this conference to enrich their professional development.

Heather Campisi is a Marketing Coordinator working out of WS+B’s New Brunswick office and also supports our Silver Spring, MD and Philadelphia, PA offices. Many of our offices have a dedicated marketing coordinator, the smaller offices sharing one. To serve the needs of the individual office on a regular basis, they also work on major projects with the WS+B Marketing Department. Additionally, there is a coordination between all the marketing people to assure the branding and message is consistent and a sharing of techniques and specializations. For instance, marketing people are responsible for the marketing of different niche and service groups, some are graphic designers, and others take control of major firm-wide events. There appears to be a seemless collaboration between the eleven marketing people employed at WS+B with Rhonda Maraziti the Director of Marketing and Practice Growth. Additionally the Firm participates in the Association for Accounting Marketing (“AAM”), a national organization of CPA firm marketing people. Each year the department sends a few from the team to this conference to enrich their professional development.

Heather is the marketing person overseeing and running the Partners’ Network, so we thought many of our readers who have interacted with her would be interested in knowing more about her role and her background.

Why did you go into marketing?

I went into marketing for a few reasons. I really enjoyed my marketing classes in college. I liked the amount of creativity and planning that the field demanded as well as the logistics behind the whole concept of marketing.

Why did you take job with a CPA firm?

To be completely honest, I didn’t look specifically for a job in marketing, and this wasn’t my first job out of college. I had interned with WS+B in the Princeton office the summer before I graduated in December 2008 from Robert Morris University in Moon Township, PA, just outside of Pittsburgh. Upon graduation, I took a position as an Account Executive selling copiers in downtown Pittsburgh. I realized this wasn’t the right track for me, and as I began to look for a job that was a better fit, I received a call from WS+B’s Director of Marketing (at the time, Catie Scaglione) that they had a position open up in the New Brunswick office. I had nothing tying me down to the Pittsburgh area, so I decided to take a chance and move to New Jersey for the position.

How did the job start out?

In the beginning, it was definitely a learning experience. Upon my hiring, Catie went on maternity leave, so I looked to the senior marketing coordinators for guidance. It was undeniably challenging at first since we all work out of separate offices. For the most part, in the beginning, it was a process of learning the ropes – who in the Firm is responsible for certain things, what the processes and procedures are, various responsibilities such as event planning, proposal work, and local office level support.

How has your position evolved and what do you do now?

My position has evolved quite a bit since I started. When I came in, my department was in a transitional phase as Catie went on maternity leave and then later resigned. Each of the Marketing Coordinators assumed more responsibilities to compensate for the loss of a Director while we looked for a new one. WS+B also brought in a growth consultant that pushed the Firm to focus more on our niche industry and service areas which in turn required more time and commitment from me towards my assigned niches: Not-for-Profit, Life Sciences, Business Advisory Services. As the Firm continued to grow, so did our attempts at proposing on new clients. I also attend various trade shows and conferences for the niches as a result of our enhanced niche focus. Alongside these jobs, I also help with database management, social media, manage and coordinate the NB office adult softball league, presentation preparation, proofing documents, event planning, and email campaigns.

How has the “style” of proposals changed since you first started preparing them?

The style of our proposals has gone through a major recreation since I have been here. Previously, our proposals were solely text based with very little graphics and color. They also appeared to be more WS+B oriented rather than prospect focused (a common trend many accounting firm proposals seem to follow). Now our proposals are much more visually appealing and directed towards the prospect’s interests. We added a photo to the front cover that correlates to the prospect’s industry, cut down text, used bullet point formatting where applicable for ease of reading, added more charts and tables, included case studies, changed the page design, separated the proposal into sections, moved WS+B to the back and showcased the prospect at the front. We are now focusing on working with the niches to streamline our proposals for each industry and service area. This will enable us to present a product that really addresses our experience in the industry and in turn, help increase our win rate. Just recently we implemented a CRM (customer relationship management) software package allowing us to better track our proposal process as well as business contacts, mailing lists and all the behind the scenes things needed for a marketing department to be successful.

How do you interact with WS+B’s marketing department?

Interaction between the marketing team takes place on all different levels. As we are all based out of separate offices, there is minimal face time on a regular basis. Our most common form of interaction/communication is through email. At times, we also use our video conferencing software. The face-to-face interaction, even though over video, makes meetings seem more personal. Then you have the normal, pick up the phone and make a call way of communicating, which we often do. One day a month the department meets to discuss pressing issues, provide updates on each of our office/work statuses and address any upcoming Firm events/projects. We also meet when there are special projects and events on the horizon. Very recently we merged with EisnerLubin and added two others to our team – their Director of Marketing and another Marketing Coordinator. I am looking forward to working with them and think they will be a great addition to the team as I met their Director of Marketing at the AAM conference I attended this past summer.

What is the structure of WS+B’s marketing department?

The structure of our marketing department is broken down vertically and laterally. We have a Partner-in-Charge of Marketing; a Director of Marketing and Practice Growth, who is the overseer of the department; we then have a group of individuals who are in charge of Marketing Communications, Proposal Writing, Interactive Marketing & Social Media and Firm Event Planning. We are also fortunate enough to have an in-house Graphics Designer who handles all of our design work – we do not outsource anything. We then have four other marketing coordinators, like me, who support our other offices and niche practice areas. One of our marketing coordinators also doubles as a support graphic designer when our full-time designer has overflow. And last but certainly not least, we have a marketing admin. In total, our department is a group of eleven hardworking, extremely bright and well rounded marketing professionals who are a pleasure to work with. I have to admit that I have NEVER seen a group of people work as well as we do together—it is a blessing to be so fortunate!

What is your interaction with partners?

My interaction with partners is on a daily basis. I don’t just have one boss, our Director of Marketing & Practice Growth, but multiple bosses as the majority of my work is for the partners. Whether I am working on a proposal/RFP, helping with a PowerPoint presentation, creating distribution lists, working on anything niche related, attending conferences and/or seminars, I am working one-on-one with the partners day-in and day-out.

What is your role with the Partners’ Network?

My role within the Partners’ Network covers a few different areas. I am responsible for planning and coordinating all of the events and making sure everything goes smoothly at those events. Part of this also includes preparing the marketing materials and newsletters, taking RSVPs, finalizing all handouts and PowerPoint presentations. I maintain our mailing lists and membership directory. Alongside this, I also handle the expense side of the Partners’ Network to ensure that we are getting the best prices and adhering to our annual budget.

Frank’s Review Notes

Partner

PROPOSED LEASE ACCOUNTING CHANGE The FASB issued an exposure draft changing how we treat leases that applies to both lessees and lessors. There have been so many comments that it is expected to re-expose the topic for further comments. Once adopted it will affect every financial statement we issue. Here is a brief summary to give you a heads up of what to expect and how to proceed.

WHAT WILL CHANGE The exposure draft changes the treatment of leases for both lessees and lessors. The proposed treatment will require tenants/lessees to record a “right to use asset” and a corresponding “lease payment obligation liability” on the balance sheet. The amount recorded on the balance sheet will be the present value of all lease payments under the lease including renewals/extensions.

The lessor will also record an asset for the right to receive lease payments as well as a liability for the lease obligation. The lessor may also have to derecognize the asset as well. There will no longer be rent expense on the income statement but rather an amortization expense for the right to use the asset as well as an interest expense.

HOW THIS AFFECTS YOUR CLIENTS The result of recording the lease on the balance sheet could cause some entities to violate certain debt covenants resulting in extra negotiations to shorten lease periods. EBITDA (earnings before interest, taxes, depreciation and amortization) calculations will also change as there is no longer rent expense but amortization and interest expense. EBITDA will be higher, thus multiples and methods for valuing an entity will also need to change.

WHAT YOU SHOULD DO You should be discussing this topic with all of your clients. The best course of action is to read the exposure draft, attend CPE on this topic and be ready to advise your client. If you don’t, another CPA might. If you want a copy of the exposure draft, email me at [email protected].

Developing Tomorrow’s Leaders

Top 11 Countdown

By John Mortenson, CPA

Partner-in-Charge, New Brunswick Office

This was presented by John at a partners’ and senior managers’ meeting. Many of the presenters had Top 10 lists – John wanted to stress the importance of our role in developing staff – so he used a Top 11. It is important to note that more than half of our partners started their careers with us – an accomplishment we do not think too many other firms can match.

This was presented by John at a partners’ and senior managers’ meeting. Many of the presenters had Top 10 lists – John wanted to stress the importance of our role in developing staff – so he used a Top 11. It is important to note that more than half of our partners started their careers with us – an accomplishment we do not think too many other firms can match.

- 11 Developing the leaders FOR tomorrow starts with hiring the leaders OF tomorrow.

- 10 Identify tomorrow’s leaders early in their career and focus on providing them the resources to grow, but recognize that some staff may be late bloomers.

- 9 The best people for staff to learn from are the Senior Staff. Our open door policy and accessibility of partners is CRITICAL to the development of staff.

- 8 Proper training for staff is not just sending everyone to CPE. It involves dedicating your time to teach and passing on the knowledge you have accumulated.

- 7 In order to effectively train someone, you need to know them on a personal level. Each person learns in a different way, and you need to tailor their development to their personality as opposed to your teaching style.

- 6 Staff need to be challenged in order to grow. No one is going to die from an improper audit procedure! Let staff make decisions and EMPOWER them to do so!

- 5 Hold staff accountable for not delivering what you expect. However, make sure that each “failure” is turned into a learning experience.

- 4 It’s easy to push blame for failures down to the lowest level. However, each success and failure is the collective result of the efforts of the TEAM from Partner down to staff.

- 3 Most feedback to staff is negative – review comments, changes to make and corrections of errors. Make sure you let them know what they do right!

- 2 Staff learn by observation. We need to set the example of what to do and what not to do. We cannot expect staff to do something we don’t. LEAD BY EXAMPLE!

- 1 Your title earns you a certain amount of respect. However, real respect from staff is earned day-in and day-out through what you do and how you conduct yourself. It is not earned by resting on your accomplishments earned back when the staff were still in grammar school.

Peter’s Taxing Issues

Partner

July and in December I presented a sold out webinar on Dealing with the IRS and three live programs all using substantially the same handout. However, I actually gave four different speeches.

For the webinar I went through the entire PowerPoint presentation and covered everything for an audience I could not see, and who were able to ask limited number of questions. The live presentations had three different focuses.

Because of the nature of each group, the proximity to me of the attendees and their ability and readiness to ask questions, the programs covered dissimilar issues. One group was concerned about the increasing number of IRS audits and how the techniques and skill levels of the agents have changed over the last dozen or so years. There is also an increase in the sophistication of tools the agents use expanding the information they have access to.

Another group was more concerned about the flood of many incorrect notices and dealing with collection matters and penalties. The IRS’ stance in reaching partial payment agreements has gotten much tougher and in many cases thwarting efforts to have taxpayers reach settlements. Also, the willingness to abate penalties has gotten stricter, further adding time to our dealing with the revenue officers and other IRS personnel. The audience participation revealed many methods that CPAs are using to get the matters reasonably managed. Another big issue was handling many years of unfiled tax returns for individual taxpayers, but the availability of access to IRS data for those taxpayers has actually made it easier to prepare such returns.

The issue that dominated the third program was an intense interest in foreigners reporting U.S. income and U.S. taxpayers reporting foreign income and accounts they had funds in or controlled. My handout has a listing of 25 different IRS forms for reporting off shore and foreigner transactions. The big issue this past year was the FBAR reporting and possible criminal charges for noncompliance. I was very busy with this and in one case filed over 50 returns for a family that did not check the box on Schedule B or report the income earned in foreign bank accounts.

The range of interests indicates the wide spread intensity of the tax professionals in dealing with the IRS and the wide range they practice in. I also present similar updates at our annual Partners’ Network Pre-Tax Season Conference in February (see info elsewhere in this newsletter) and at our annual CPE Conference in June. And being updates, the topic is always fresh and different. Further, do not hesitate to contact me with any questions you have. The many calls I get keep me up-to-the-minute in IRS issues. Email me at [email protected].

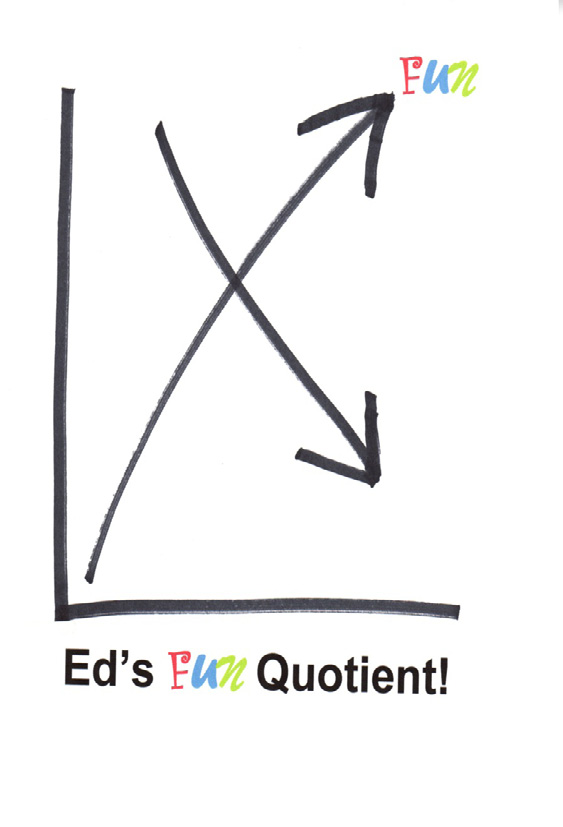

12 Ways to Have More Fun in Your Practice

[author-style]By Edward Mendlowitz, CPA[/author-style]

- Quicker Billing: The lower the gap between doing the work and getting paid – the more fun you’ll have

- Anxiety busters: TIO, DIN, MIT: The lower amount of what you put off till tomorrow – the more fun you’ll have [TIO: touch it once; DIN: Do it now; MIT: Identify and work first on your most important thing]

- Putting the Q in your oversight procedures: The lower the staff errors – the more fun you’ll have

- More effective hiring and training: The lower your turnover – the more fun you’ll have

- Commoditization: The lower your non standardized procedures – the more fun you’ll have

- Interaction with clients: The lower the number of clients requesting a meeting instead of you precipitating it – the more fun you’ll have

- Partner retreats away from home : The lower the disparity between you and your partners – the more fun you’ll have

- Running more effective meetings: The lower amount of control others have of your meetings – the more fun you’ll have

- Building personal wealth outside of your practice: The lower your worry about your future financial security – the more fun you’ll have

- Revenue from clients: The lower your write offs – the more fun you’ll have

- Niches: The lower the array of services you personally need to be expert in – the more fun you’ll have

- What clients really want: The lower your client discontent – the more fun you’ll have

The Partners’ Network

Why should my firm join The Partners’ Network?

- To broaden your firm’s services and expertise

- To help you build your business for growth and profitability

- To obtain answers to challenging audit and tax matters with a phone call

- To get ideas and tips on how to better manage your practice

What does The Partners’ Network offer a firm like mine?

Again, many answers:

- Free Power Breakfast covering timely topics.

- Discounts to the annual CPE Conference in June.

- Invitation to the Pre-Tax Season CPE program.

- Answers to your questions on tax, accounting, auditing, or practice management at no charge. Just pick up the phone and call, or send one of us an e-mail.

- Contacts with peer CPA practitioners, and opportunities for exchanging ideas, resources, and information with your colleagues.

How do I join?

Membership is $145 per year ($500 for firms of 100+). Phone or e-mail Heather with your credit card information, or put a check and business card in the mail. It’s as easy as that. So give Heather a call today at 732.828.1614, or send an e-mail, [email protected]. We look forward to hearing from you soon.

Succession Planning

Succession Planning will help your company continue to succeed -even after you’re gone.

Begin planning for the extended life of your company. Call us today to discuss which options are best for your company’s future.

Ed Mendlowitz, CPA/ABV/CFF, Partner

732.828.1614

Services to CFOs and Controller

- Tax basis conversions to GAAP

- Sales tax compliance issues

- Corporate state tax preparation

- Income taxes for foreigners working in U.S. and U.S. employees working abroad

- Transfer tax studies

- Internal auditing

- M&A due diligence

Ed Mendlowitz, CPA/ABV/CFF, Partner

Frank R. Boutillette, CPA/ABV, Partner

732.964.9329 | 212.829.3238

Peer and Quality Reviews

We are registered with the Public Company Accounting Oversight Board (PCAOB) and are available to perform your peer review.

Call us for more information.

Frank Boutillette, CPA/ABV, Partner

732.828.1614

Independent Business Valuation Services

Objectively determining the value of business enterprises and assets.

Call us for more information.

Ed Mendlowitz, CPA/ABV/CFF, Partner

732.828.1614

Accredited in Business Valuation (ABV) by the American Institute of Certified Public Accountants.

The Partners’ Network Newsletter is published by WithumSmith+Brown, PC, Certified Public Accountants and Consultants. The information contained in this publication is for informational purposes and should not be acted upon without professional advice.

How Can We Help?