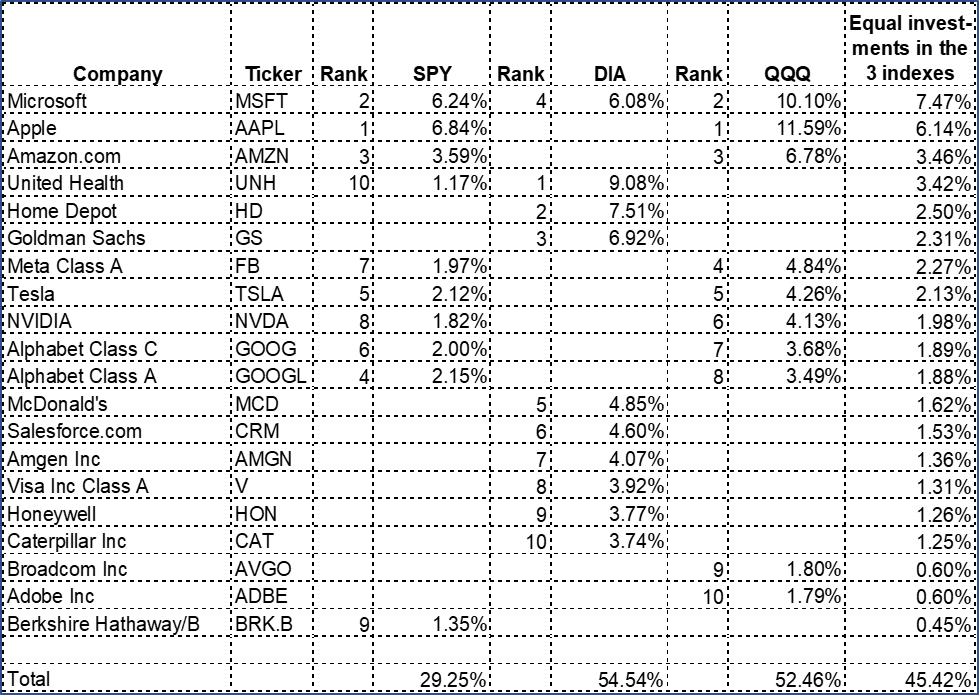

Following are charts with comparisons of the three major stock indexes where I show the top 10 components of each index and of the sectors they indexes comprise, and what you will one if equal amounts are invested in funds comprised of each of those indexes. Also is a chart showing the 30 components of the Dow Jones Industrial Average (“DJIA”) and the relative weights of each stock in that index. All values are as of the close of business on December 31, 2021.

I used for the comparisons the exchange traded funds for the three indexes rather than the underlying data for the index. There is minimal difference with the S&P500 and DJIA indexes, but a material difference with the NASDAQ 100 index. However, it is pretty easy to purchase a QQQ index fund, and I wanted to use that to show what you would be actually investing in. The ticker symbols are SPY for the S&P500 index, DIA for the DJIA and QQQ for the NASDAQ100 index. Notice that 8 of the top 10 S&P500 stocks are also in the QQQ while the DIA only has two that are in SPY and one in QQQ. Different indexes for different purposes.

I will show 2 more charts next week and then will discuss the charts and last year’s market performance.

Comparison of the Three Major Stock Indexes

Following is a chart showing the top 10 components of each of the three major indexes and the ranking of the stocks in those indexes. The chart also shows the percentage of each stock you will own if you invest equal amounts in each of these three index funds. It is sorted by the last column.

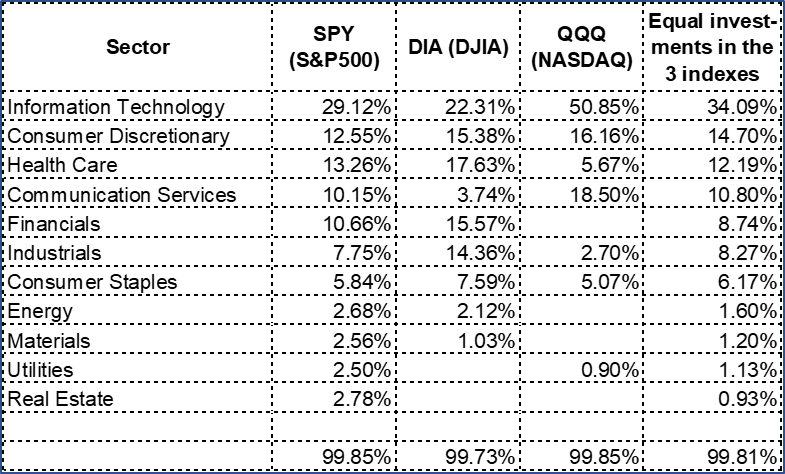

Three Major Indexes by Industry Sector

The following is an analysis of the three major indexes by industry sector as of December 31, 2021. It is sorted by the last column.

The largest sector is information technology, and it is about half of the NASDAQ 100, 29% of the S&P500 and 22% of the Dow Jones Industrial Average (DJIA). If you own equal amounts of the three index funds, the total for that sector is about 34%. Consumer discretionary is second with 14.7% with all three indexes having a similar weight of this sector, but health care is third with the three indexes having much different weighting in this sector. These indexes are constructed differently and provide different market exposure. On another note, health care is about 17% of the U.S. economy so the DJIA seems to be a better reflection of the overall economy in that regard. Manufacturing and construction make up about 17% of our economy and the DJIA is much closer for this also. Real estate is not really represented in the DJIA and QQQ, and if you want to cover this in your investing, you would need to seek out funds beyond these three, or beyond the DIA and QQQ. These index funds serve a great purpose but are not a catch-all for every type of investing.

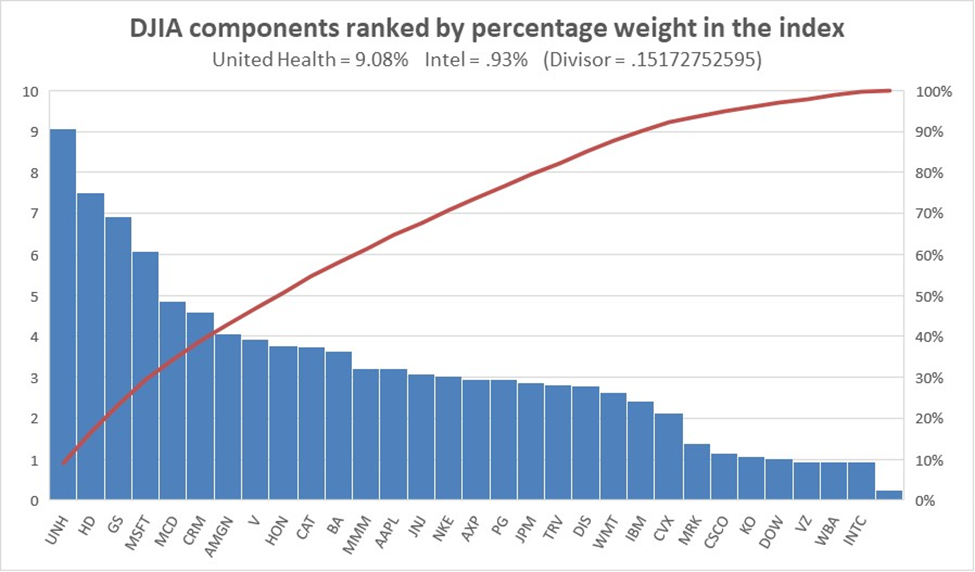

Dow Jones Industrial Average

Following is a chart showing the 30 stocks comprising the Dow Jones Industrial Average (DJIA) and the relative weight of each stock in the index as of December 31, 2021.

The Dow Jones Industrial Average is a major index and is usually the first index mentioned on news programs when they report about the daily stock market performance. The other two major indexes are the S&P 500 (with 500 components) and the NASDAQ (with over 2500 components) indexes.

As important as this index is, it is only comprised of 30 stocks. Each stock has been chosen to represent its industry and is considered a “blue chip” stock. That means it is a relatively strong, stable company and representative of its industry, according to the DJIA board that selects the index components. Look over the listing and see how many companies’ names you recognize.

DJIA Index Divisor

The divisor which is shown under the chart title is the “amount” that of each $1 change in an Index’s component is divided by to determine its effect on the Index. For example, if United Health (the highest weighted stock in the index) goes up by $1 that will affect the index by about 6.59 points. That is determined by $1 ÷ .15172752595 = 6.59 (rounded). A $1 change in Intel (the lowest weighted component) will also affect the index by that same 6.59 points.

The difference in the importance or weight is that a $1 change in United Health which was $504 on December 31, 2021 is about a .2% change in that company’s value, while a $1 change in Intel which was $52 is a 1.9% change in its value. Another way to look at this is that if both companies were to change by 2%, United Health (2% x $504 = $10) would affect the DJIA by 66 points (10 ÷ .15172752595) points while Intel by about 7 points ($52 x 2% = $1.04 ÷ .15172752595). Therefore, United Health has a much greater effect than Intel on the index. In other words, the higher-priced stocks have a much greater effect on the index than the lower-priced stocks.

As an FYI, when Apple split in 2020 4 for 1, its $500 price dropped to $125, moving its weight from the top to the lower part of the middle. It is now in the upper part of the middle bloc. You can notice in the top 10 chart that Apple is not in the top 10 of the DJIA, while it is the top stock in the other two indexes. The reason for this is that the S&P 500 and Nasdaq indexes are capitalization (or company market value) weighted. That means that the changes are based on the aggregate changes in the market value (or capitalization) of its components.

The DJIA divisor changes every time there is a change in a component of the index. Some of these changes are because of stock splits, mergers, acquisitions, dividends paid with stock (rather than cash), spin-offs and even changes in the index components. The purpose of the divisor is to maintain the index on a consistent measure so it can be compared with the past and used to track the future. I could present an illustration of how the divisor is calculated, but that would be something like explaining how a hot dog is made, which might be interesting, but who really cares? However, the divisor is shown daily inThe Wall Street Journal,where it shows the previous day’s change in the DJIA index. BTW, when Apple split, the divisor changed to maintain a balance and consistency of its effect on the Index.

Contact Us

If you have any tax, business, financial or leadership or management issues you want to discuss please do not hesitate to contact me at [email protected] or click here.