Noteworthy Revisions and Updates to the 2014 Form 990 Schedule L Instructions

Background on Schedule L

According to the IRS the purpose of Schedule L is “used by an organization that files Form 990 or 990-EZ to provide information on certain financial transactions or arrangements between the organization and disqualified person(s) under section 4958 or other interested persons. Schedule L is also used to determine whether a member of the organization’s governing body is an independent member for purposes of Form 990, Part VI, Line 1b.”

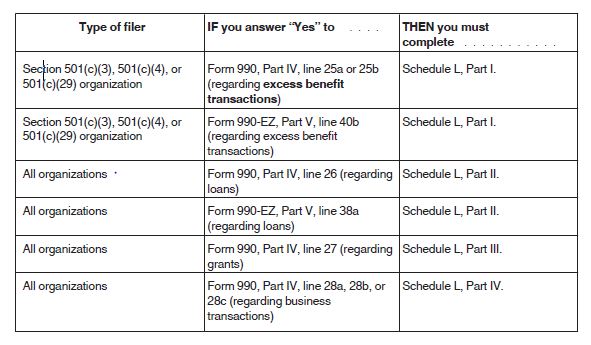

The Schedule L instructions include the following chart which provides detail as to which organizations must complete all (or various parts) of Schedule L.

Definition of “Interested Person”

The most significant change to the 2014 Schedule L instructions concerns the definition of an interested person” for purposes of Schedule L, Parts II – IV. Previously, a separate and distinct definition of an “interested person” existed for each part of Schedule L. The 2014 definition of an “interested person” for purposes of Schedule L, Part I, Excess Benefit Transactions, remains the same as 2013 and is still defined as “a disqualified person under Internal Revenue Code Section 4958”.

In an effort to standardize the definition of an “interested” person and provide users of Schedule L with more clarity and consistency, the IRS has updated and expanded the definition of an “interested person” for purposes of Schedule L, Part II (Loans to and/or From Interested Persons); Part III (Grants or Assistance Benefiting Interested Persons); and, Part IV (Business Transactions Involving Interested Persons). This definition, for purposes of Schedule L, Parts II – IV has been made uniform and includes:

- Current or former officers, directors, trustees or key employees required to be listed on Form 990, Part VII, Section A; and, current officers, directors, trustees or key employees listed on Form 990-EZ, Part IV;

- The creator or founder of the organization, including the sponsoring organizations of a VEBA;

- A substantial contributor, which is defined as an individual or organization that made contributions during the tax year in the aggregate of at least $5,000 and is required to be reported on Form 990, Schedule B, Schedule of Contributors, for the organization’s tax year. A substantial contributor may include an employer that contributes to a VEBA;

- For purposes of Part III, a member of the organization’s grant selection committee;

- A family member of any individual described above;

- A 35% controlled entity of one or more individuals and/or organizations described above; and

- For purposes of Part III, an employee (or child of an employee) of a substantial contributor or of a 35% controlled entity of such person, but only if the employee/child received the grant or assistance by direction or advice of the substantial contributor or designee or of the 35% controlled entity: or, under a program funded by the substantial contributor that was intended primarily to benefit the employee/child.

Importantly, entities of which a current or former officer, director, trustee or key employee, or family member, was serving as an officer, director, trustee or 5% partner or shareholder are no longer considered “interested persons”.

Other Noteworthy Changes

Other significant changes to the 2014 Schedule L instructions have been made and include, but are not limited to, the following:

- The identification in Part V of Schedule L of the organization’s manager, if any, that knowingly participated in an excess benefit transaction (Part I) is now required to be reported;

- Payments made pursuant to a split-dollar life insurance arrangement that are treated as loans under IRS Treasury Regulation 1.782-15, and other advances and receivables, are now required to be reported in Schedule L, Part II;

- A “highest compensated employee’ is no longer considered an “interested person” for purposes of Schedule L, Part II; and

- Part IV now includes a new exception for transactions with publicly traded companies in the ordinary course of the publicly traded company’s business on the same terms as it generally offers to the public;

Uniform Definition of “Reasonable Efforts”

In addition to creating a uniform definition for “interested persons”, the Schedule L instructions also contain a definition of “reasonable effort” to state that “the organization is not required to provide information about a transaction if it is unable to secure sufficient information to conclude that the transaction is reportable after making a reasonable effort to obtain such information”. The instructions include an example of what an acceptable reasonable effort may constitute.

In 2013, separate definitions of “reasonable efforts” existed for purposes of Schedule L, Parts III and IV. The separate definitions of “reasonable efforts” for purposes of Schedule L, Parts III and IV have been removed and the definition included in the “Specific Instructions” section is to be uniformly applied in these instances.

Conclusion

The majority of these changes are designed to encourage consistency and to create more uniform definitions for users of the Form 990. It is important that tax-exempt organizations familiarize themselves with these changes and reassess relationships and transactions. The new definition of an “interested person” should be taken into account when reviewing these transactions.

Ask Our Experts

Please contact a member of WS+B’s Healthcare Services Group at [email protected] for further questions or assistance.

The information contained herein is not necessarily all inclusive, does not constitute legal or any other advice, and should not be relied upon without first consulting with appropriate qualified professionals for your individual facts and circumstances.