Are You a Multistate Corporation? Master How to Source Your Sales of Intangibles and Services!

States provide two overarching approaches: Cost of Performance and Market-Based Sourcing.

Cost of Performance (“COP”)

COP sourcing attributes receipts to the state in which the income-producing activity is performed. If the income-producing activity is performed in more than one state, states generally assign the receipts to the state in which “a greater proportion of the income-producing activity is performed based on costs of performance.” Though most will source in proportion of the performance of the majority of income-producing activities, certain states will try to source those sales no matter how small the activities are performed in-state (i.e., via the “proportionate” method).

Market-Based Sourcing

Market-based sourcing attributes receipts to the state of the taxpayer’s market for those sales. States refine this to mean where the purchaser “received the benefit of the service,” the “in-state situs of the individuals/customers/businesses where the receipts are derived,” or the “site of the performance of the services.” If this state cannot be “readily determined,” the services are considered to be received at the customer’s home or, in the case of a business, the office of the customer from which the services were ordered in the regular course of the customer’s trade or business.

However, certain states (i.e., Connecticut) may apply their own other unique take on either of these methods, or may pick one method for services and another for intangibles.

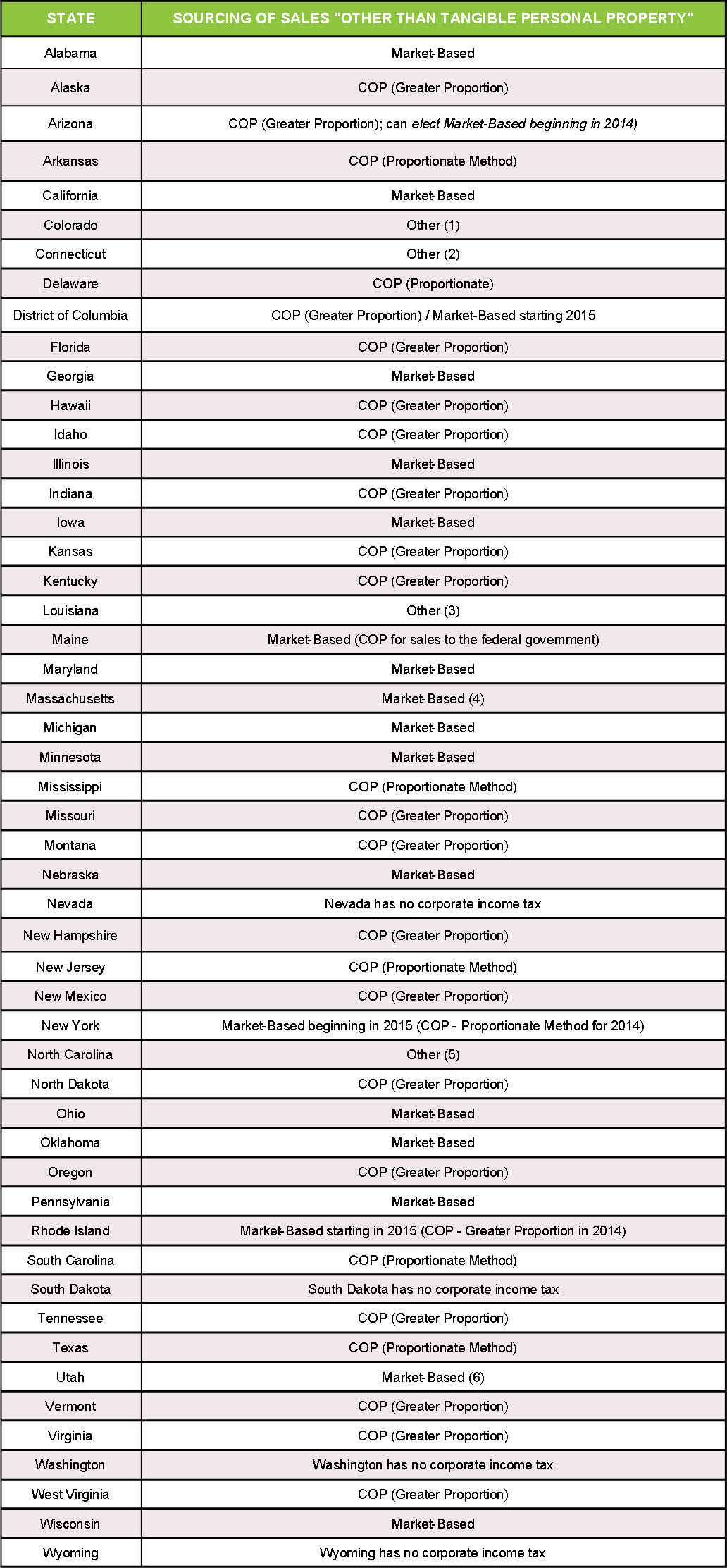

The chart below will help interpret these rules for your return and estimate preparation.

However, please note that certain industries have particular sourcing methods (i.e., financial institutions and trucking companies) and unique treatments that may deviate from the general guidance below. We encourage you to reach out to a member of WithumSmith+Brown’s State and Local Tax Services Group to discuss how we can ensure you determine your sales factor accurately and avoid underpayment, penalties and audits.

FOOTNOTES

- Sales, other than sales of tangible personal property, are sourced to Colorado as follows: Revenue from services rendered in Colorado; Interest / dividend income as well as gain from the sale of intangible property if the taxpayer’s commercial domicile is in Colorado; Patent and copyright royalties, if and to the extent that the patent or copyright is utilized by the payer in Colorado, or the patent or copyright is utilized by the taxpayer in a state in which the taxpayer is not taxable and the taxpayer’s commercial domicile is in Colorado.

- Receipts from services performed within Connecticut are sourced to Connecticut [i.e. Market-Based]. Receipts from the net gains from the sale or other disposition of intangible assets managed or controlled within Connecticut are sourced to Connecticut [i.e. Location of Management or Control] Rentals and royalties from properties situated within Connecticut as well as royalties from the use of patents or copyrights within the state, interest managed or controlled within the state, net gains from the sale or other disposition of intangible assets managed or controlled within the state must be sourced to Connecticut [i.e. Location of Management or Control].

- Louisiana law does not expressly address the sourcing of receipts from the sales of other than tangible personal property. Receipts from services are sourced to Louisiana if the services are performed within the state, though the state provides no guidance regarding when services will be deemed to be “”performed in the state.”” However, receipts from the sale of intangibles must be sourced to Louisiana if the intangible has acquired a business situs in Louisiana, or, in the absence of such a business situs, Louisiana is the commercial domicile of the taxpayer.

- Sales of intangibles will be sourced to Massachusetts if, in the case of a lease or license of intangible personal property, the intangible property is used in Massachusetts.

- Sales are sourced to North Carolina if the receipts are from intangible property and are received from sources within North Carolina; or the receipts are from services and the income-producing activities are in North Carolina.

- Phrased as “if the purchaser of the services received a greater benefit from the service in Utah than in any other state,” applying a “greater proportion” methodology to market-based sourcing.

If you have any questions, please contact a member of our National Tax Services Group at [email protected].

|

Stephen Basiaga, JD, LLM 609.520.1188 [email protected] |

Ask Our Experts

To ensure compliance with U.S. Treasury rules, unless expressly stated otherwise, any U.S. tax advice contained in this communication is not intended or written to be used, and cannot be used, by the recipient for the purpose of avoiding penalties that may be imposed under the Internal Revenue Code.