The Market Approach: Errors to Avoid

Under the Market Approach, data from the sales of companies in the same or similar line of business is utilized to derive valuation multiples (e.g. price to EBIDTA or price to revenues) that are then applied to value the subject company. This approach is comparable to appraisals of real estate, in which sales of same or similar properties (comparables) are utilized to develop the value of a subject property. Although the concept seems simple, there are numerous issues that, if not identified, can materially alter the conclusion of value. The balance of this article will address some of the common issue areas that can materially distort a valuation using the Market Approach.

Same transaction reported in multiple databases

A transaction may be reported in more than one database. As such, appraisers must be aware and eliminate any duplicate transactions to make sure it is not double counted.

Stock and asset sales are different

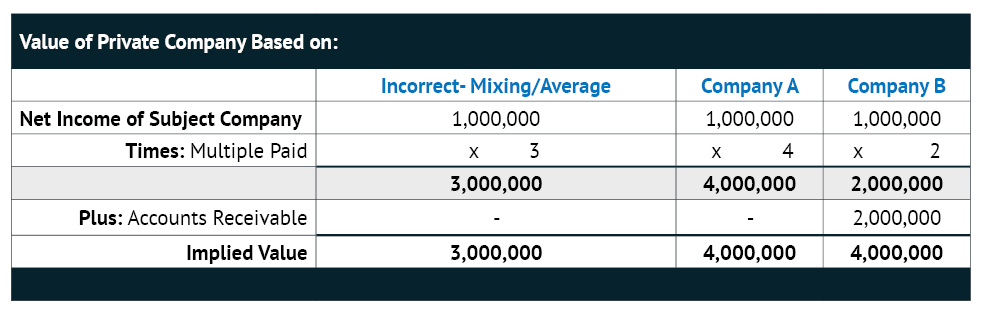

A purchaser can either acquire the stock of an entity or the assets of an entity. Each of these transactions have distinct characteristics, therefore, it is important to carefully examine the potential comparable transactions to determine what is and what is not included in the transaction price. In a stock sale all of the assets and liabilities at the date of the transaction are transferred to the purchaser. However, in an asset sale, only specific assets and liabilities are transferred. For example, assume Company A sells its stock at a price to net income multiple of 4. Company B, however, entered into an asset sale and transferred all of the assets and liabilities, with the exception of $2M of accounts receivable, at a price to net income multiple of 2.

Mixing the multiples from the stock and asset transactions and utilizing an average multiple of 3, results in a distorted value. However, by calculating the transactions separately and applying the appropriate adjustments relative to the asset sale, the valuation results are the same based on the two different multiples.

SIC or NAICS codes don’t guarantee “same or similar”

It is important to fully scrutinize the details of transactions from a database before applying the observed multiples. Although two companies may be in the same industry, there could be significant differences that make them not comparable. For example, if a supposed comparable company was owner-operated with only one employee but the subject company has 200 employees, they may be difficult to compare. Additionally, the description of the reported SIC or NAICS code should be reviewed as often times companies report under the incorrect code.

Time is of the essence

In selecting data on merged and acquired companies, there is a tendency to utilize data from transactions that occurred after the valuation date of the subject company. The use of such subsequent data may or may not be appropriate, as the concept of “known and knowable” may apply. Certain Standards of Value do not allow for events, information or data that were not known or knowable as of the valuation date.

Conversely, if transaction data is very old, consideration needs to be given as to whether the data remains valid and reliable for use in valuing a company as of the present valuation date. If more recent information is also available and confirms the ranges exhibited in the older data, it may be appropriate to incorporate that data. However, if newer data paints a different picture, it may be evidential that the industry conditions have changed and the older data is no longer an accurate indication of current value.

Price includes contingencies

The reported sale price of a closely-held company may or may not represent the present, cash equivalent value. Sale terms often include contingent payments based on revenue retention or earn-outs based on continued or increased profitability. In addition, structured payouts may not bear interest or may include interest at below market rates, thereby distorting the true economic price of the transaction. Therefore, it is important to understand the terms of the transactions and if such information is not available, the observed valuation multiples should be used with caution, if at all. In other words, the terms of the deal dictate the price of the deal.

Application of discounts

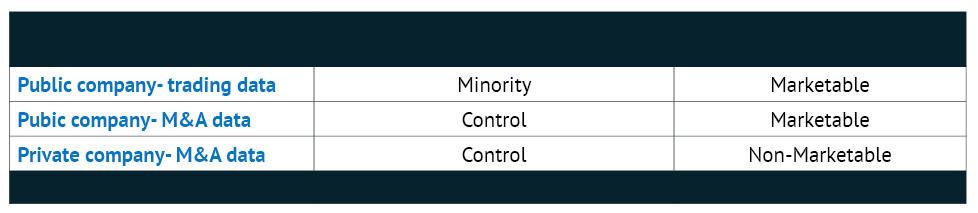

The application of marketability and minority discounts are a function of the data utilized to calculate value. An appraiser must understand the differences between applying private company and public company multiples and the result on implied value. The three types of data and their resulting values are:

Based on the general rule of implied values above, lack of control discounts may not be applied when calculating value from merger and acquisition data, whether public or private, since those multiples could result in control values. Additionally, due to its ready market, public company data, whether from actively trading stock or merger and acquisition data, results in a marketable value implying that discounts for lack of marketability may be applicable.

In conclusion, the proper use of the market approach requires the appraiser to have a solid understanding of the underlying data as well as its effect on the subject company’s resulting value. As demonstrated, failing to properly understand and utilize the data can result in inaccurate and unreliable results.

|

Jessica Giresi, CPA 732-504-2400 [email protected] |

Ask Our Experts

To ensure compliance with U.S. Treasury rules, unless expressly stated otherwise, any U.S. tax advice contained in this communication is not intended or written to be used, and cannot be used, by the recipient for the purpose of avoiding penalties that may be imposed under the Internal Revenue Code.