An Accountant’s Perspective on the Mortgage Industry September 2015

Are Increasing Costs of Regulatory Compliance Threatening your Business?

Are Increasing Costs of Regulatory Compliance Threatening your Business?

By Lauren Grossi, CPA

While new regulations help achieve stabilization within the industry, there is also a great price to pay and, unfortunately, small to mid-sized originators and servicers will be impacted the most. Recent regulations – including Real Estate Settlement Procedures Act (Regulation X), Truth in Lending Act (Regulation Z), Dodd Frank, and the new TILA-RESPA rule to be adhered to as of October 3, 2015 – must be followed, leaving mortgage lenders with no choice but to comply or consider retreating from the business.

Are you preparing for the major changes that the upcoming Truth in Lending Act (TILA) and Real Estate Settlement Procedures Act (RESPA) integrated disclosure requirements will bring?

The TILA-RESPA rule becomes effective on October 3, 2015, creating even more concern about loan quality and costs of compliance. The TILA disclosure and good faith estimate will be combined into a new disclosure called the Loan Estimate, and the final TILA disclosure and HUD-1 settlement statement will be consolidated into a new disclosure called the Closing Disclosure. The Loan Estimate must be given to consumers within three business days of applying for the loan. The Closing Disclosure must be received by the consumer three business days prior to consummation. These new rules include requirements for producing and delivering these two disclosures which will significantly impact your bank’s operations. Areas of your business that may be impacted are policies and procedures, employee training, information technology, vendor relationships and customer service.

How can you cut costs?

Low profitability, escalating expenses, and increasing regulatory compliance have forced mortgage lenders to look for ways to increase productivity and compliance while reducing overall operating costs. As compliance risk is a top priority for most lenders, they may need to contemplate outsourcing due to these increased regulations and associated costs of compliance. For example, the post-closing loan quality control and mortgage servicing functions may no longer be performed in house. In addition to outsourcing, lenders can look to create efficiencies by increasing volumes as well as using technology to help streamline processes. Consider negotiating contracts for non-lending related costs that you can control such as reviewing health insurance and other expenses not related to loans.

Consider the following

Due to increasing regulations and compliance costs, banks continue to lose money on mortgages and debate retreat from the business. Failure to comply with these rules could result in unprecedented fines and penalties, costing your bank thousands of dollars in lost business. To help assess how prepared your company is for the increasing regulations coming this year, be sure to review and evaluate your current compliance costs and other expenses. At WithumSmith+Brown, we are experts in analyzing expenses and can assist with budgeting and managing compliance costs. We would be happy to discuss how other current developments in accounting and financial reporting would affect your business.

|

Lauren Grossi, CPA 973-898-9494 [email protected] |

Ask Our Experts

To ensure compliance with U.S. Treasury rules, unless expressly stated otherwise, any U.S. tax advice contained in this communication is not intended or written to be used, and cannot be used, by the recipient for the purpose of avoiding penalties that may be imposed under the Internal Revenue Code.

“Good Problems”

“Good Problems”

[author-style]By Jeanette Emmons, CPA[/author-style]

I apologize for the use of the phrase ”Good Problems”…. It’s one of my most hated phrases. Problems are problems, how can any of them be good? None the less, the phrase is perfectly suited to the topic at hand. The classic catch 22 for every business owner – “Hooray, we are profitable! Oh no, now it’s tax time and we were profitable!”

I wish I was writing with better news, but a recent chief counsel advice handed down further clarification of how the mark-to-market rules create taxable income for mortgage bankers, but cannot be turned around to create taxable deductions, except in the hopefully rare occasion that the value of a held loan has dropped below par. Let me explain.

The definition of a security in the mark-to-market rules (section 475) captures mortgage loans held for sale creating a requirement to mark them to fair value at the end of the tax year and recognize any gains (or losses) in the current tax year. Because mortgage bankers are in the business of originating loans to sell at a profit on the secondary market, this mark to market adjustment will almost always result in a net taxable gain. Mortgage bankers have long wanted to take tax deductions for loan loss provisions to help offset some of the gain from marking to market, but tax rules clearly prohibit deducting allowances.

To qualify as a tax deduction a liability must meet the all events test and economic performance requirements of section 461(h) and Treas. Reg. section 1.461-1(a)(2). The ruling in Bell Electric Co. v. Commissioner from all the way back in 1965 establishes that the reserve for warranty losses on the sale of mortgages would not be properly treated as either a deduction or reduction of the sales price.

Memorandum 201529006 from the chief counsel addresses an attempt by a taxpayer to treat reserve losses related to repurchase and indemnity obligations (warranty and representations obligations as securities subject the 475 mark-to-market rules. A taxpayer argued that with each loan origination a derivative right to put the loans back to the originator was created and should therefore be viewed as a separate security upon which gain or loss is determined under section 475. And while throwing around words like derivative will often shut down the opposing party and get you your way, the memorandum does not agree with this position. The IRS concluded that taxpayer could not disavow the form of the origination transaction. Because the W&R obligations are a standard provision in a mortgage sale contract that are material and integral to the contract, they are not independent financial instruments. Further, unlike the value of options or similar derivative instruments, the value attributable to W&R obligation would not be driven by market forces, but rather by discovery of a breach, failure to cure or negotiation. In short, the IRS shut down the W&R obligations and a security argument quickly and completely.

We often hear stories from clients who are receiving advice from parties that are not accountants or tax attorneys suggesting that they can save taxes by deducting loan loss reserves, however, this is generally false. As you can see in the preceding examples and cases, the IRS has been very direct on this issue. Please, seek the advice of a tax professional and get relevant regulations or court rulings to support any positions taken. Saving taxes is great, but the down side of having the IRS reverse an unsupportable position on a tax return can take good problems and make them very bad!

|

Jeanette Emmons, CPA 973-898-9494 [email protected] |

Ask Our Experts

Buyer Beware: The Risk of Mergers & Acquisitions in the Mortgage Banking Industry

Buyer Beware: The Risk of Mergers & Acquisitions in the Mortgage Banking Industry

[author-style]By Jessica Offer, CPA[/author-style]

While there has been numerous acquisitions of regional banks and smaller to mid-sized mortgage banks by larger national and regional firms, mergers have been less prevalent due to the added complications that arise. The larger entities can leverage economies of scale due to their far reaching resources and larger balance sheets. This allows for a more streamlined workforce and additional liquidity to navigate the ever complex and changing regulatory environment and volatile marketplace. A decision to sell your business (or buy one) is not one to be taken lightly, however, it’s proving to be a successful move for many enterprises.

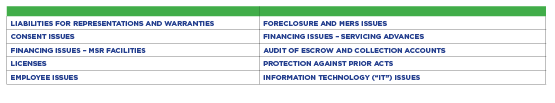

There is always risk for a buyer when acquiring another business regardless of whether it is an asset or a stock purchase. Given the volatility that has plagued the mortgage industry, there are heightened areas that buyers should consider when contemplating a merger or acquisition of a mortgage company. In a recent article published by Mayer-Brown, they noted the Top Ten Issues in Mortgage M&A to be the following:

Companies should be aware of these highlighted areas and consider “what could go wrong” in the future, even if everything seems satisfactory on the surface at the time. Acquirers should request purchase price adjustments accordingly for potential exposure and/or request certain indemnification language be included in the purchase agreement. Sometimes what looks too good to be true might just be too good to be true.

Before an acquisition is completed, most buyers go through a due diligence process whereby an independent consultant (usually a public accounting firm) performs various inquiries of the target’s management and a review of financial and operational data in order to identify and quantify (if applicable), the business risks including financial, legal, operational, and tax consequences of completing the acquisition (as previously agreed to between the acquirer and the consultant). As noted above, there are certain risks that are strictly isolated to the mortgage industry which should be thoroughly scrutinized before acquiring another company and should be considered before selling your business.

Deloitte’s M&A Institute has also published a report on top banking M&A issues in 2014 and 2015, some of which is pertinent to the mortgage industry. Their article focuses on a few additional key issues such as rising interest rates, valuation issues, and “deal readiness.”

Interest rates – which are important because they impact volume and pricing, thus affecting profitability and margins.

Valuation – given the volatility of the industry and the estimates involved in foreclosures rates and discounted cash flows for example, how does one effectively value a privately held mortgage company?

Deal readiness – deal readiness relates to a company’s ability to be attractive to buyers and to pass the due diligence “smell test”. Does the company know its strengths and weaknesses, are they running below capacity, is additional headcount needed, are there potential tax exposures/liabilities, etc. Before entertaining possible buyers, companies should fully understand their position in the market.

Overall mergers have seemed less popular than acquisitions due to the conflict that can arise when two companies with different infrastructures and cultures become one, in addition to potential valuation issues. Companies may not have aligned goals and objectives either. Mergers can, however, lead to great synergies for companies looking to expand in a certain region, or add a new line of business.

As many smaller banks and firms continue to struggle with keeping pace with the new regulatory requirements, maintaining the necessary minimum liquidity, and remaining profitable, the mergers and acquisitions epidemic in this industry shall continue.

At WithumSmith+Brown, we are experts in understanding your industry and how to help you better position your company for sale or to support you with your business goals to enter into an acquisition or merger.

|

Jessica Offer, CPA 973-898-9494 [email protected] |

Ask Our Experts

Say Hello!

Say Hello!

Find WithumSmith+Brown at the upcoming Northeast Conference of Mortgage Bankers and Professionals on September 28th – October 1st at Atlantic City and say hello to us.